Craft beer’s rise has led adults to try new styles and types of beer. Meanwhile, craft beer venues from microbrewery taprooms to the brewpubs of regional craft breweries often serve as gathering places in their community.

Craft brewers are now among the food and drink companies around the world that are financially affected by mandated closures of bars, restaurants and other gathering spaces as part of measures to slow the spread of COVID-19. Following mandated closures, craft breweries around the world face difficult decisions about how to sell their beer, whether to maintain staff and, for some, if they can stay in business.

Efforts to support – and, in some cases, to save – struggling craft breweries of all sizes will be essential to keep beer creative and maintain its community connections.

Craft has authentic connections with local communities

Although COVID-19 is a global situation, consumers are feeling the effects on personal and local levels. Many consumers are focusing their efforts on helping their communities by supporting local businesses.

The devotion to local will outlast the shutdown, as shown by the three-quarters of Chinese adults, surveyed by Mintel in April 2020, who would like to buy more Chinese brands to show support after the outbreak. Investing in craft brewers is an authentic way to support homegrown businesses.

Improve volume sales with low-cost craft beer

Price was the inspiration for Australia’s Otherside Brewing Co. to create Plan: C Simple Ale. As stated on pack, “Coronavirus has meant we’ve had to re-think every bloody thing. We understand that no matter how much you like brilliantly crafted beers, nowadays paying the little extra it takes to create handmade products is really tough to justify.”

The brewery is delivering 18-packs for AU$40. In contrast, six-packs of craft beer range from AU$19-$24, according to Mintel GNPD.

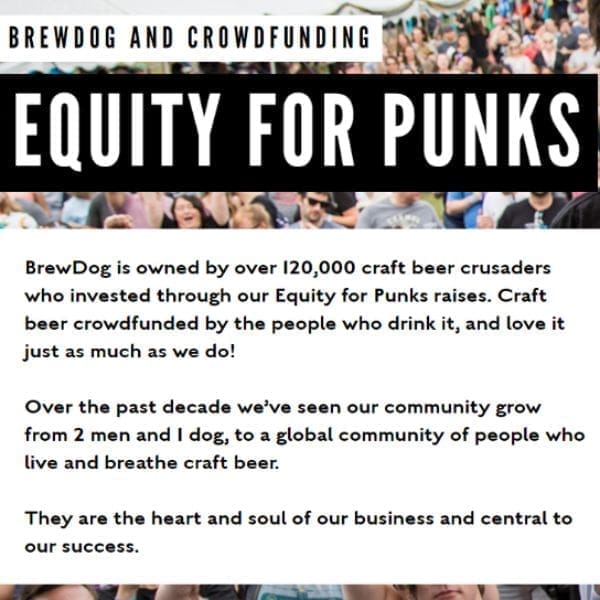

Offer loyal fans the chance to invest

During this trying time, craft breweries can offer consumers the opportunity to invest in the brewery. For example, Scottish craft brewery BrewDog has made crowdfunding a cornerstone of its business. In March 2020, BrewDog USA emailed fans suggesting they could support the brewery by buying BrewDog beer or investing in the latest round of Equity for Punks USA crowdfunding that is open until mid-May 2020.

Craft beer pioneers can make investments and acquisitions

The craft beer industry prides itself on independent ownership. The value of staying independent might make a struggling craft brewery wary of “selling out” to multinational companies or investors. However, the on-premise shutdowns during COVID-19 could lead to long-term economic issues for smaller breweries. Thus, the need for cash flow will create an opportunity for established craft brewers that have led to the expansion of craft beer to invest in or acquire smaller breweries.

These partnerships could be positioned as financial support and as opportunities for small craft breweries to learn from the pioneers and leading craft beer brands. In early 2019, Sierra Nevada, the third-largest US craft brewer in 2019, made its first-ever acquisition. Sierra Nevada bought emerging post-activity beer maker Sufferfest Beer Company, which has shared values and mutual growth potential.

Incubation could be beneficial for brewers big and small

Leading global brewers, such as Anheuser-Busch InBev (AB InBev) and Carslberg, have already made commitments to philanthropy and corporate social responsibility in the wake of COVID-19. As a further commitment to the brewing community, leading global brewers could help struggling craft brewers in 2020. Incubation is one collaboration model that has unique benefits for both parties.

Incubation programs, as used in beauty and by major retailers, provide small companies with support, funding and input from big companies. In turn, big companies can learn from the often more nimble small companies. Moreover, incubation could help global companies improve their reputation for craft beer. In the US, just one in 10 US adults who drink beer agree large manufacturers can make good craft beer. At the same time, small breweries can gain the benefits of the economies of scale for supplies, marketing and distribution from the large brewers.

What we think

Many craft breweries will struggle to retain their revenue while on-premise venues are shut in the hope of slowing the spread of the COVID-19 outbreak. As a sector that has taken pride in fostering connections among local communities, consumers and fellow brewing companies can be called upon to return the favor and help support struggling craft breweries. From buying beer to purchasing a stake in a brewery, consumers and fellow brewers large and small have the potential to work together to keep the beer industry diverse and creative.