In a world where pets are increasingly treated like children, it seems unsurprising that the diets of pampered pooches are being adjusted to match their lifestyles. Indeed, German pet owners continue to demonstrate year after year that they are willing to open their wallets to pamper their pets.

With an estimated 28 million pets taking residency in German households and pets playing such a key role in the lives of many consumers, there is a strong trend appearing towards humanisation of pets in Germany. In fact, according to Mintel seven in 10 German pet owners admit their pets are being treated more like children, while two out of three Germans who own a pet apply the same quality standards for their pets’ food as their own. These attitudes translate into increased spending habits, as doting pet owners are encouraged to spend more on quality pet food and pet care products.

Growing demand for functional pet foods and treats

Health and well-being are becoming of primary importance as today’s pet owners look for healthier options when choosing pet food. Almost half of German cat or dog owners admit to buying treats which bring certain health benefits, whereas over a third give preference to functional pet food in order to keep their cat or dog in good health.

As more consumers choose pet foods that go beyond just providing an adequate supply of nutrients, the demand for health enhancing pet food grows. German cat and dog owners are paying increasing attention to ensure that their pets avoid consumption of highly processed foods and excess calories, migrating to premium functional pet foods, treats and snacks.

How are pet food manufacturers responding to consumer interest?

In 2014, the number of pet food launches in Germany carrying functional claims on-pack almost tripled from 2013 launch numbers. There was also a rise in pet food launches with low/no/reduced formulations as reduced calories, fat, sugar or cholesterol launches increased, suggesting a growing focus on addressing pet obesity.

In line with the Europe-wide trend towards more natural pet foods, gluten-free pet food is standing out among other speciality pet food blends because of its growing popularity among German pet owners. In line with their owners, a growing number of pets suffer from allergies, digestive disorders and other food-related illnesses resulting from a diet that is not natural for animals, particularly cats and dogs.

Grains, such as rice, wheat, corn or soy have been used widely in pet foods, often being found in lower quality pet foods as cost-reducing fillers. However, grains do not carry essential nutritional value for cats and dogs and can potentially be harmful for them as they can contribute to obesity and diabetes and trigger food allergies. Looking to protect their pets are two in five German consumers who are interested in a wider selection of allergen free food products for their pets. Pet food products are also increasingly recognising pet owners’ desire to move away from grains and other sources of gluten, for example, starches.

In Germany, gluten-free launches have been particularly prevalent in the dog food market. For example, Greenwoods White Fish & Rice Complete Adult Dog Food, launched in Germany March 2015, that claims to be free from added beef, pork, wheat gluten, egg, dairy, soy and unhealthy and artificial additives.

Also launched in Germany in early 2015, Dogz Finefood No. 2 Juicy Jewelz Dry Dog Food with Duck comprises a cereal free semi-moist dry dog food with lots of meat and selected ingredients which provide necessary omega 3 and 6 fatty acids.

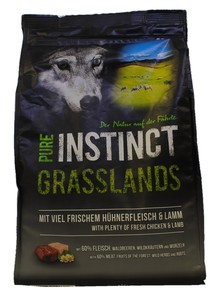

Finally, Pure Instinct Grasslands Dry Dog Food, launched in Germany at the end of 2014, claims to be free from grains, chemical preservatives, colourants and flavourings. The product is said to be suitable for dogs with cereal intolerances or coeliac disease.

The appeal of gluten-free food revolves around the question – to what extent are dogs able to digest wheat protein? Although dogs can tolerate carbohydrates, switching dogs to a gluten-free diet is thought to minimise exposure to potential allergens and to eliminate digestive discomfort.

Katya joined Mintel as a Senior Food & Drink Analyst in 2014, based in the London office. With a dedicated field of focus on Germany, Katya draws on her comprehensive knowledge of this market to identify and explore the major trends across various FMCG categories and provides insights needed to successfully navigate the German market environment. Katya brings over seven years of expertise in market research and grocery industry, including regular field research trips in Germany and hands-on experience from her previous role in the strategic development of private label at METRO Group.

![[WATCH] 2 household care brand innovations tapping into the upcycling ingredient trend](https://www.mintel.com/app/uploads/2022/10/SocialMedia_EMEA_Upycling-Ingredient-Trends_Blog_1000x305-1.jpg)