British Lifestyles: The NHS tops list of UK’s most cherished institutions

The NHS tops the list of what makes British consumers most proud, according to Mintel’s latest flagship British Lifestyles report.

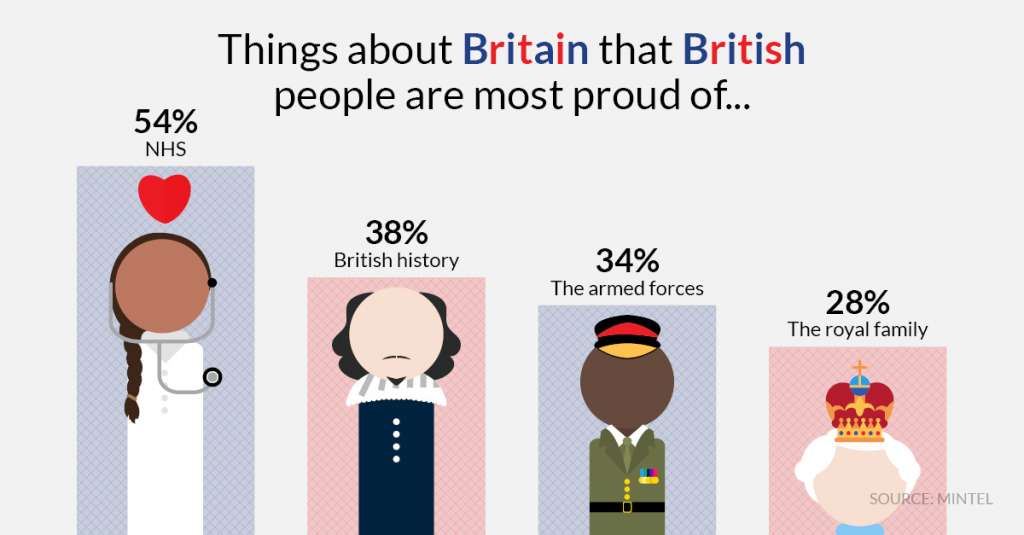

As it celebrates its 70th anniversary on 5 July 2018, over half (54%) of all adults include the health service in their list of ‘British things’ in which they take the most pride. The NHS ranks significantly higher than the next popular choices, including British history (38%), the British armed forces (34%) and even the Royal Family (28%).

Support for these institutions is much higher among older consumers; 66% of those aged 65+ are proud of the NHS, compared to just 21% of 16-34-year-olds. This older cohort is also more than twice as likely to be proud of the royal family than their younger counterparts: 43% of those aged 65+, compared to just 20% of 16-34-year-olds. By contrast, the younger generation is more likely to take pride in British food (20%) and British sportspeople/sporting achievements (18%), compared to just 9% and 13% (respectively) of those aged 65+.

Jack Duckett, Senior Consumer Lifestyles Analyst at Mintel, said:

“The NHS is at the heart of the UK’s affections. For many Brits, the universal healthcare service has become a symbol of a fair society, delivering free at the point of access services for all, irrespective of wealth or financial contributions.

“Older adults are the most likely to have selected the NHS as their biggest source of pride, reflecting their status as the services’s longest standing financial contributors, as well as increasingly its most reliant patients.

“By contrast, younger adults are less focused on traditional British institutions, proving instead more likely to take pride from more recent British success stories. For instance, while in the past the UK has often been mocked for its food culture, the British food scene has undergone a transformation over the last 10-15 years, with food markets and innovative restaurants creating a new generation of foodies. In addition, the UK’s outstanding performance at the 2012 and 2016 Olympic Games cemented the UK’s reputation as a world leader in sport, making brand ambassadors out of many of the athletes involved.”

There’s more to the UK than London

Despite the high level of pride Brits take from traditional institutions, a far higher proportion (69%) of Brits agree that it’s actually the people that make Britain what it is, while 58% believe that Britain has a strong identity. However, 64% think businesses place too much focus on London, while the same proportion believe brands should do more to celebrate the areas they are based in (64%) and 56% say that businesses in the UK should do more to cater for those who live outside towns and cities.

“London has a global reputation for business, with its world-class access to specialist talent and sustained job growth. However, the high living costs and long commutes are seeing an increasing number of people choose to leave the city. This could provide a boon to businesses outside of London as it makes it easier for them to access talent traditionally associated with the capital, while also benefiting from the typically lower operational costs.” Jack notes.

Brexit: cost of living concerns, but consumer spending to hit £1.25 trillion

There has been a marked increase in the number of consumers worried about how Brexit will impact their regular costs: 51% of adults said Brexit will have a negative impact on the cost of living in December 2017, up from 46% who said the same in July 2016.

Despite this, the UK’s relatively resilient economy means that consumer confidence has continued its upward trajectory over the past five years, with 72% of adults today describing their financial situation as healthy/OK, up from just 66% in 2012. This has helped to increase total consumer spending to £1.25 trillion in 2017, an increase of 3% on 2016 when spending stood at £1.2 trillion.

“Consumer confidence has continued to improve over the last five years, although the uncertainty surrounding Britain’s future role outside of the EU could limit any hopes of a greater increase in consumer confidence. This is perhaps already being reflected by more modest growth in consumer credit than has previously been seen, and could mean more cautious consumer spending in the near future.” Continues Jack.

This is the 28th year Mintel has published its flagship British Lifestyles Report. The research tracks spending across all major consumer markets. Highlights for 2018 include:

The road to in-home sobriety… but are alcopops making a comeback?

Just over a quarter of UK adults (26%) reduced their spending on alcoholic beverages bought to drink at home last year. This figure rises to 34% of 25-34-year-olds, among the key consumers of alcoholic drinks. Health and saving money are the key reasons that consumers give for cutting back on alcohol.

While Brits are reducing their in-home drinking expenditure, Mintel highlights the potential for ready to drink (RTD) alcoholic cocktails. These were a surprise success story in 2017, with volume sales up by almost 7% and the category received a boost from strong new product development from brands and own-label.

Consumers drinking less alcohol could provide a boost for soft drinks. Over six in ten (63%) UK adults would consider drinking fruit juice, juice drinks or smoothies as alternatives to alcoholic drinks. Smoothies in particular grew by an impressive 21% between 2016-17, as they benefited from a ‘health halo’ around positive nutrition.

Rise of dapper, younger men and online shopping

Menswear and online shopping are tipped as top performers for the fashion industry. While the UK fashion market experienced weaker sales growth in 2017, Britain’s young men are stepping out in style, with over half (53%) agreeing that buying new clothes is about keeping up with the latest fashion trends. As such, a third (33%) of men aged 16-24 spent more on clothes and accessories in the last year. Spending on menswear has increased as men are faced with greater choice of where to shop. Consequently, men have become less brand loyal, with 31% buying from four or more retailers on the high street and 24% online.

Online sales of clothing, fashion accessories and footwear shot up by 17% in 2017 to reach a stylish £16.2 billion, as consumers adapt to the convenience of buying fashion online and the ease of buying via mobiles helps to fuel online demand.

Sweet smell of fragrance success

While the fragrances and body sprays market saw a 3.3% decline in sales between 2014 and 2016, falling from £1.52 bn to £1.47 bn, the category generated an increase in value last year, rising 0.7% to £1.48 bn in 2017.

Sales were buoyed by innovations from high-end brands targeting a wider range of shoppers, including Millennials and middle-income consumers. Meanwhile, high street fashion brands became more competitive by increasing their appeal to price-conscious shoppers.

Decline in eating out while in-home enjoys inflation boost

A third (33%) of Brits say they spent less on eating out in the year to January 2018, a slight increase from the 31% who said the same in the previous year. Two-thirds of adults (66%) who say they cut back their spending on eating out last year say it was to save money. But despite mounting cost pressures and economic uncertainties, the value of the UK foodservice market (including eating out and takeaways) continues to grow, reaching an estimated £70 billion in 2017.

The total value of the in-home food market reached a six-year peak of £82 billion in 2017, largely driven by food price inflation. Defying the struggles of the bread category, ‘bread with bits’ (eg nutrient-dense grains, seeds, oats) rose 11% during 2017, overtaking standard brown bread to become the second biggest segment in pre-packed bread. Meanwhile, potato crisps/chips enjoyed a revival in volume sales in 2017 (up 5%), following a stagnant period between 2012-2016, with own-label one of the important driving forces behind this recent volume growth.

Staycation vacation

Faced with a relatively weak Pound-to-Euro exchange rate, value-driven consumers are more likely to consider cheaper European destinations in order to economise on holiday expenditure. However, the long-haul market is expected to become a more attractive option in 2018 due to the rise of transatlantic budget airlines and a more favourable Pound-to-Dollar exchange rate compared to 2017.

Staycations should continue to prosper. A quarter (24%) of adults say that if they won £1,000 to spend on holiday, they would spend it all on one or more holidays in the UK. Meanwhile, 61% say they don’t see enough of the British countryside, suggesting that many might take the opportunity to explore rural locations closer to home.

Press review copies of Mintel’s British Lifestyles UK 2018 report and interviews with Jack Duckett, Senior Consumer Lifestyles Analyst, as well as Mintel’s team of category analysts, are available on request from the press office.

Jack Duckett is an Associate Director for Consumer Lifestyles Research. He specialises in reports exploring the attitudes and behaviours of different demographic groups.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo