The water crisis hits home: Water shortages are the fastest-growing global environmental concern amongst consumers

- 51% of global consumers now believe their country is suffering from climate change, up from 44% in 2021.

- 46% of global consumers say that eco-activists have raised their awareness of environmental issues.

- Plastic pollution falls out of the top three environmental concerns among global consumers.

Water shortages are the fastest-growing global environmental consumer concern, according to new research from Mintel’s annual Global Outlook on Sustainability*.

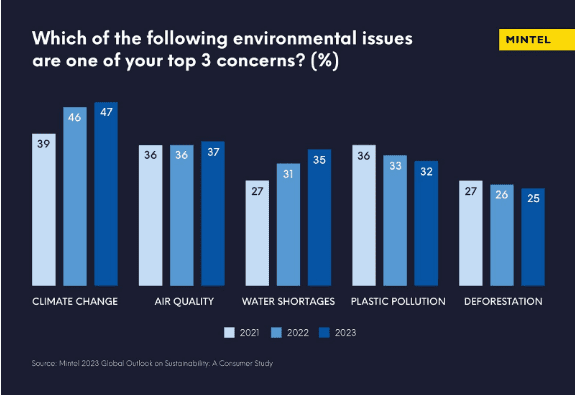

The number of consumers globally who rank water shortages in their top three environmental concerns has risen from 31% in 2022 to 35% in 2023, representing a 13% increase and a faster rise in concern than any other environmental issue in the last year. In 2021, less than three in ten (27%) consumers globally worried about water shortages.

Escalating fears have resulted in water shortages pushing plastic pollution out of the top three environmental concerns, with concern around plastic pollution (eg ocean plastic) falling from 36% in 2021 to 32% in 2023. In fact, water shortage is the number one environmental issue in Mexico (26%), Spain (25%) and France (20%), while tying in first place with climate change itself in Brazil (16%) and Italy (20%).

Meanwhile, climate change remains the world’s number one environmental concern. The proportion of global consumers citing climate change as one of their top three environmental issues stands at 47% in 2023, up from 39% in 2021.

Overall, the proportion of consumers globally who believe that their country is suffering from climate change is now in the majority (51%), up from 44% in 2021. However, opinion varies across the regions. Less than half of UK (42%) and US (46%) consumers believe their country is suffering from climate change, increasing to 56% of Germans.

Richard Cope, Senior Trends Consultant, Mintel Consulting, said:

“Consumers’ growing prioritisation of water shortages as a top three environmental concern reflects how water stress has become a reality worldwide. The ascent of water shortages from fifth to third place in consumers’ list of environmental priorities is symptomatic of a population directly impacted by—as opposed to increasingly informed about—climate change. This marks a new era where environmental concerns become pressing issues of self-preservation, such as water and food shortages and a desire to conserve resources for future resilience. While plastic pollution remains a prominent concern it is sliding down consumers’ agendas as they increasingly focus on their personal supply shortages and are educated to realise that other issues might be generating more emissions.”

Half of global consumers believe eco-activism is a legitimate form of protest

Frequently a topic of controversy, Mintel research reveals that just under half (46%) of consumers globally say that eco-activists have raised their awareness of environmental issues. However, across the globe, the impact of climate activism on consumers varies significantly. Just a fifth (22%) of German consumers say that these activists have raised their awareness, rising to three in 10 in the UK (30%) and France (31%). Meanwhile, the impact is considerably higher in Canada (34%) and the US (36%), and peaks in Indonesia (80%) and India (69%). And while many consumers are paying attention to activists, around half (47%) say eco-activists who create disruption (eg by stopping traffic) should be penalised by the government.

“It’s clear that eco-activists are having an impact, and are even seen as legitimate protestors, in many markets. In fact, our research shows that eco-activists are welcomed as educators in many markets, especially in the Asia-Pacific and Latin American markets. Activists are also becoming instrumental in holding brands to account for greenwashing. As activists educate the world on energy, sourcing and distribution emissions, consumers will increasingly adopt a more informed, considered and holistic view of these impacts.” Adds Richard.

Consumers distrust carbon offsetting as a solution

As many as two-thirds (66%) of consumers say they would prefer for companies to reduce their own carbon emissions rather than use Carbon Offsetting programmes outside of their own area of business—highlighting a growing disconnect between consumers’ and companies’ goals. This comes as almost two in five (38%) global consumers say they don’t trust companies to be honest about their environmental impact.

When asked what would encourage them to consider buying more responsible products, 41% say they look for a score of how environmentally impactful the product is (eg colour coded, 1-5 score), highlighting the convenience of a Nutriscore-style colour-coded impact labelling system

“Our research shows that, on a global scale, consumers don’t want brands to engage in carbon offsetting. Projects preventing deforestation form the basis of most carbon credit programmes used by corporations to assert the carbon neutrality of their businesses or products, but in the wake of media coverage around the challenges in validating these schemes, it’s understandable that the public is challenging companies to become more involved and invested in reducing their emissions directly.

“Based on the success of the food industry’s nutrition traffic light system, consumers want brands to use a similar system that makes it easy to understand the environmental impact of the products they’re thinking of buying and helps them make more sustainable choices.”

Consumers want governments to provide more incentives

Just 34% of consumers globally agree that the country where they live offers sufficient financial incentives to install new energy innovations in their home (eg subsidies to install heat pumps, insulation or solar panels). Similarly, a third (33%) of consumers say the country where they live offers them sufficient financial incentives to lease/buy an electric vehicle (eg subsidies for vehicle purchase/loan costs, installing a charger at my home).

“Whilst many consumers may support state regulation and dissuasion, they are largely united in feeling that governments are not doing enough to incentivise green behaviours, specifically concerning transitioning towards cleaner energy and transport.” Concludes Richard.

*Mintel’s 2023 ‘Global Outlook on Sustainability: A Consumer Study’ tracks the environmental and social priorities, purchasing behaviors, engagement, and level of understanding of sustainability topics among consumers from 16 countries. Learn more about the research findings and how Mintel is helping businesses lead effective change here.

Additional research and interviews with Richard Cope are available upon request from the Mintel Press Office.

For the latest in consumer and industry news, top trends and market perspectives, stay tuned to Mintel News featuring commentary from Mintel’s team of global category analysts.

-

Global Outlook on Sustainability: A Consumer StudyCheck out how to help businesses lead effective change that resonates with and inspires consumers....View our reports store

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo