In the Inflation Exploration blog series, Mintel explores all the ways that inflation effects consumers around the globe.

Recent inflation is bringing new pressures to consumers who identify their financial situation as Tight, Struggling or In Trouble. Consumers are feeling pressure regardless of their financial situations, but more restricted household budgets could face broad consequences, as 75% of US adults see a link between their financial wellness and personal wellbeing, and 80% of adults with a Tight financial situation and 91% who are Struggling or In Trouble agree their finances regularly cause them stress.

Higher grocery prices are just one of the things compounding the troubles that US adults who are Tight, Struggling or In Trouble already face. Companies can be allies for these budget shoppers by promoting discounts, bulk items, store brands and everyday low prices.

Tight, Struggling and In Trouble consumers see a range of money-saving options

Tight, Struggling or In Trouble consumers are familiar with money-saving tactics, like changing what they buy. Less affluent shoppers are also more likely than adults with Healthy finances to shop for groceries at Walmart and dollar stores.

Store brands are key for budget shoppers. 39% of US grocery shoppers who are Struggling/In Trouble and 34% with Tight finances have bought more store brand products during Covid-19, versus 21% of shoppers with self-defined Healthy finances.

Here are eight ways brands can target US grocery shoppers:

1. Promote more ways to use store brands

Retailers can promote low-cost meals made with store brands. This can help shoppers who are Tight, Struggling or In Trouble because they are more likely than Healthy consumers to plan meals in advance.

Recipes can include ways to repurpose leftovers, a common tactic among the Struggling.

Stores can also reward private label purchase: almost half of grocery shoppers who are Struggling/In Trouble want loyalty rewards for store brand purchases, versus 34% of all shoppers.

Source: Mintel

2. Focus on convenience and value to compete against fast food restaurants

The foodservice habits of consumers who are Tight, Struggling or In Trouble show that convenience is another key attribute for this group. Consumers with Tight financial situations are most likely to be frequent fast food customers. About a third (34%) of US fast food customers who have Tight finances visit fast food restaurants once per week, and another third (32%) more than once per week.

While fast food can be seen as a value, a majority of fast food consumers who are Tight, Struggling or In Trouble have noticed higher prices at fast food restaurants. Brands and retailers can emphasize the low prices on convenient packaged meals or ingredients for adults and children.

More than a third of US fast food consumers who are Tight, Struggling or In Trouble say value menu options are important when choosing a fast food restaurant, which is more than the quarter of fast food consumers with Healthy financial situations.

3. Highlight in-store savings that help Struggling shoppers make room in their budgets for comfort

Shoppers who are Tight, Struggling or In Trouble keep some flexibility when shopping. Almost half of US grocery shoppers who are Struggling/In Trouble shop from a list, but often add or subtract items as they shop. Adjustments could be made to stick within a budget or to make room for treats.

Struggling/In trouble consumers make room for impulse purchases. More than a quarter of US adults who shop the center of the store and are Struggling/In Trouble say they usually purchase center-of-the-store items on impulse versus 18% of center-store shoppers overall.

These impulse purchases could be to take advantage of discounts on pantry staples. The center of the store also is home to comfort foods like salty snacks and cookies. Retailers can use cross-category bundle deals to help consumers save on essentials and make room in their budgets for treats.

4. Make it easy for OK consumers to maintain their stockpiles

More than half of US adults with OK financial status say they have always been stocked up on essentials during Covid-19, which is higher than consumers from other financial groups. Maintaining a stockpile likely offers a sense of security to these consumers, whose budgets can fluctuate based on monthly earnings or expenses.

The desire to maintain a stockpile and the potential for extra room in their budgets means OK consumers are key targets to buy in bulk, or to purchase items during multi-item promotions.

Source: Jewel Osco

5. Highlight the versatility of pantry staples

Brands can help OK consumers, either those who have their own stockpiles or those who regularly buy long-life items, understand the versatility of shelf-stable, canned or frozen food.

Companies can use packaging and online channels to offer recipe ideas for long-life products.

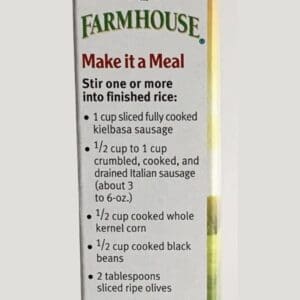

Farmhouse Mexican Style Rice suggests five budget-friendly ingredients that make its rice into a meal.

Source: Farmhouse Foods

6. Combine food savings with fuel savings

In addition to higher food prices, the rising price of gas and diesel fuel in the US adds stress to consumers, especially people who can’t work from home. Retailers can take inspiration from Midwestern US grocery store HyVEE, which promotes specials that increase the discounts from its Fuel Saver program.

Source: Mintel ePerformance

7. Help OK consumers stay on track with healthy eating goals

Consumers with OK financial status are slightly more likely than Healthy, Tight, Struggling or In Trouble consumers to say they have been buying healthier foods since Covid-19.

Inflationary price rises might compromise OK consumers’ health goals. The USDA is predicting prices will rise in 2022 for healthy food categories including fresh fruits, meat, poultry, eggs and processed fruits or vegetables.

Higher price rises might lead OK consumers to reconsider their healthy eating goals. Companies can promote the affordability of food with better-for-you claims: OK consumers were more likely than consumers of other financial situations to say high protein, low sugar, low calories and low carb claims became more important to them during Covid-19.

8. Address concerns about out-of-stocks among consumers with Healthy finances

Companies can reassure consumers with Healthy finances that they will be able to find their favorite brands. Healthy grocery shoppers have been more worried than shoppers of other financial statuses about products being in-stock since 2020. In March 2022, almost half of US adults with a household income of $100k+ said they think the Ukraine conflict will lead to stock shortages in stores.

Retailers or brands with direct-to-consumer websites also can promote shopping online as a way to get one’s preferred brands or varieties. More than half of Healthy grocery shoppers say they are shopping online more during Covid-19.

What we think:

Assist Tight, Struggling or In Trouble shoppers: Consumers who say their financial situation is Tight, Struggling or In Trouble make up nearly one quarter of the US population. Companies can be allies for these consumers by helping them plan and buy affordable meals, and by providing budget-friendly indulgences that help them treat themselves or their families.

Relieve the squeeze on OK consumers: Inflation will restrict the budgets of more than a quarter of consumers with OK financial situations. These consumers do not have much extra left over after they pay their monthly bills. OK consumers will be drawn to promotions that help them stock up or save on expenses like gas. They also will need affordable options to maintain healthy diets.

Ease the compromises made by Healthy shoppers: Nearly half of US adults describe their financial situation as Healthy, meaning they have money left over for luxuries or to save. Brands can appeal to these Healthy consumers with substitutes for restaurant meals, large stocks of preferred brands and ethical products that help Healthy shoppers give back with their grocery purchases.