November was another fantastic month for the US auto industry, which totaled 1.24 million sales, a 9% increase over November 2012. That growth resulted in a very high seasonally adjusted annual rate (SAAR) of 16.4 million, a post-recessionary SAAR high, not matched since February 2007 before the Great Recession began.

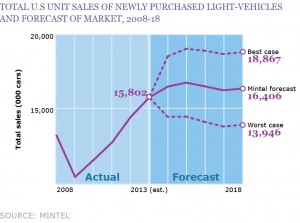

Mintel predicts a bullish end to 2013 auto sales, capping out another year of strong recovery for this segment. Overall, Mintel predicts approximately 1.58 million vehicles will be sold for the month of December, or a total of about 15.8 million vehicles for calendar year 2013, a total 9.1% increase for the industry over 2012.

This is the fourth-consecutive year of growth in U.S. vehicle sales and marks the longest such run of consecutive growth since 1995-2000. Even so, U.S. vehicle sales are still at a lower level in absolute terms, when adjusting for population gains, than what we saw from 1999-2006. It was in those years that the industry regularly sold 16 million to 17 million vehicles annually.

Looking forward, Mintel does see the industry getting back into its 16-17 million annual vehicle sales rate, albeit at the lower end, starting in 2014. Mintel predicts a little more than 16.5 million light vehicles will be sold in 2014, or a 4.7% increase from 2014. Unfortunately, the music will likely stop there, as the industry starts to butt up against its new natural equilibrium of optimal sales. We’re starting to see shifts, or a slowing down in car purchasing among key emerging consumer groups who will contribute toward a larger proportion of car sales in the not-to-distant future.

The continued reduction of vehicle miles traveled, an increase in late-model used vehicles, shifting demographics (e.g. a decline in Baby Boomers in the labor force), the higher than historical costs of gasoline, declining, or delayed, licensing among Millennials, a reduction in vehicle ownership among those 19-36 years old, and an increase in multimodal forms of transportation, such as public transportation, walking and biking, will slow down potential growth in this industry. In addition, the delay of several life stages, including full-time employment, marriage, and childrearing, among Millennials, and more Millennials choosing to live in dense urban cores, has reduced vehicle miles traveled, which has had the impact of delaying or forestalling new car purchases for many in this cohort.

Mintel projects a small increase in 2015 sales, with volumes reaching 16.8 million, but beyond that sales should remain stagnate from 2016-18 due to the above described market drivers. Mintel doesn’t expect the market to reach, or near, 17 million annual vehicle sales, as experienced from 1999-2006, for the foreseeable future. Mintel expects stagnate and cyclical growth in the automotive sector, with a total of 16.4 million new light-vehicles sold in 2018.

About Mintel Forecasts:

Mintel has produced this forecast using advanced statistical techniques including stepwise, multivariate regression, and the autoregressive procedure using the statistical software package SPSS. The model is based on historical market-size data taken from Mintel’s own market-size database and supplemented by published macroeconomic and demographic data from various private and public sources including the Federal Reserve Board, the U.S. Commerce Department, the Census Bureau, the Council of Economic Advisers, and the Congressional Budget Office and the Economist Intelligence Unit (EIU). The model searches for relationships between actual market sizes and a selection of relevant and significant macroeconomic and demographic determinants (independent variables) to identify those predictors having the most influence on the market. Given the market complexities, including cyclical factors, and governmental regulations and policy decisions, affecting the market, data was tested over a long time series, with vehicle volume sales data from 1990-2012 included. Main determinants for this forecast included unemployment data and the population of the major target consumer group for new cars; 45-54-year-olds (45-54 are the cohort representing peak licensed drivers, and peak vehicle miles traveled (VMT)).

For more information about Mintel’s automotive insight or more musings from Colin Bird, follow him on Twitter here.