The world of consumer packaged goods (CPG) has undergone drastic changes in recent years. From the rise of functional drinks to consumer demands for healthier options, companies are striving to stay ahead by rethinking their innovation strategies. One standout move?

PepsiCo’s 2025 acquisition of the Poppi brand for an impressive $2Bn. And while they undoubtedly explored the development of a similar offering, they bypassed the innovation process and acquired Poppi.

Why Did PepsiCo Acquire Poppi?

PepsiCo’s acquisition of Poppi isn’t just another business deal; it’s a calculated strategy rooted in the complexities of changing consumer trends. Poppi, originally launched as Mother Beverage, was later rebranded as Poppi after founders Allison and Stephen Ellsworth pitched and secured an investment on Shark Tank seven years ago for their apple cider vinegar-infused soda brand. Poppi has gained a loyal following by blending functionality, taste, and health-conscious attributes.

I wish I could say I discovered Poppi at farmer’s markets in my current city of Dallas, TX where it was originally sold, but I’ve had it in stock in my home refrigerator ever since I first found it.

See, the apple cider vinegar contains prebiotics and probiotics that help with gut health. And, in addition to tasting really good, Poppi is low in sugar and calories. These are soda traits popular with younger consumers, in particular. As for someone like me managing an autoimmune condition, my doctor actually recommended Poppi as a good alternative to some of the beverages I was currently drinking.

Sounds great, but why would one of the world’s largest consumer goods companies pursue non-organic innovation and purchase Poppi instead of developing its own alternative prebiotic beverage and squashing it in the market? They chose to acquire an established and rapidly growing brand because innovation is becoming increasingly complex in the CPG space.

Is There Innovation Stagnation in the CPG Industry?

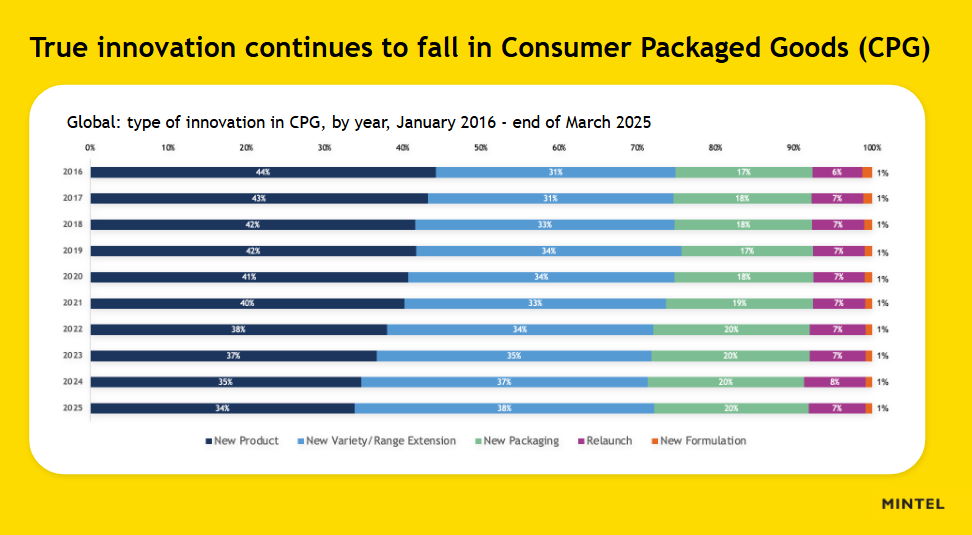

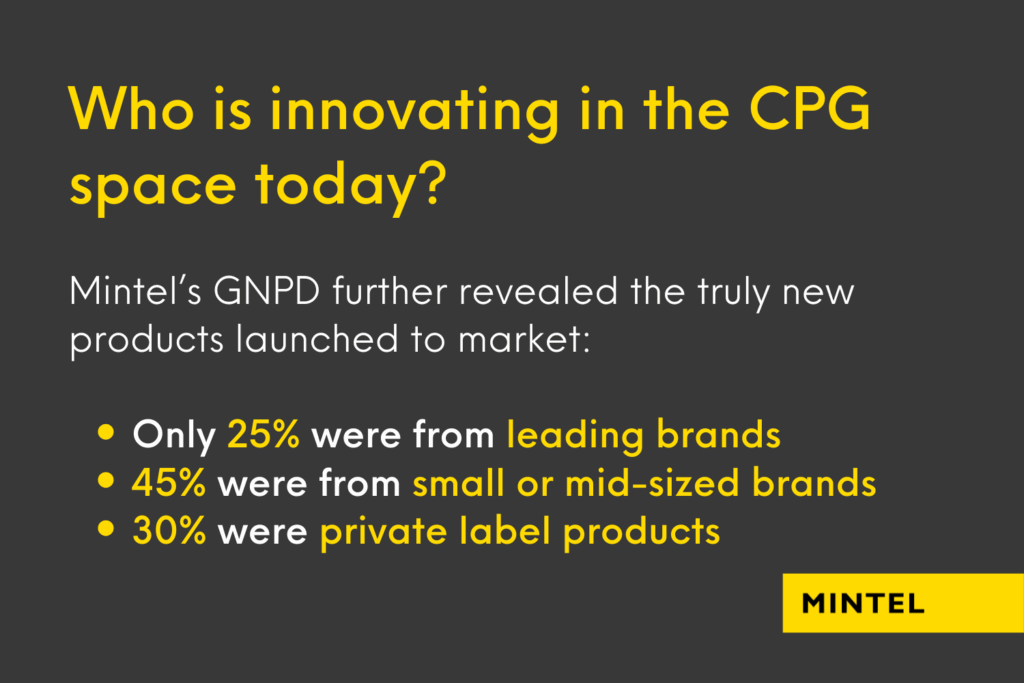

Innovation is often seen as the lifeblood of growth in the CPG industry, however, innovation that produces truly new products is at a low point. According to Mintel’s Global New Products Database (GNPD), in the first 5 months of 2024, only 35% of new product launches were truly new-to-market innovations. This is the lowest figure in the 28-year history of Mintel tracking new product launches. This figure drops even lower in the food and drink category (26%). This highlights an ongoing challenge for large brands when it comes to pioneering new ideas.

This begs the question of why innovation isn’t coming primarily from leading brands. When I was growing up, corporate innovation labs were king. My father spent his entire career at 3M, where he began as a biology grad from Kalamazoo working in the labs. I remember him telling me that 3M had a corporate goal of at least 25% of revenue coming from products launched in the past 5 years. I thought, “‘Wow, this is a real commitment to innovation!”’ That kind of goal feels novel today.

Just as it is easier for a small producer to find an audience for its products, it is also much easier for a large company to find innovators in the categories in which they operate. Shark Tank is one of many examples of a modern-day media vehicle that can serve as a matchmaker.

Second, especially in the US, the legal and financial barriers to incorporating and manufacturing a product have continued to decline, alongside increased visibility and access to capital. According to the Commerce Institute, the number of companies formed per year in the US has more than doubled since 2016.

Third, company tenure for employees is declining. According to the Bureau of Labor Statistics, average employee tenure in 2024 was 3.9 years, which was the lowest since 2002. This has an even greater effect in R&D roles, which often require a certain set of skills and involve projects that span multiple years. Internally developed innovation often depends on institutional knowledge, which sees products develop from a seed of an idea to technical feasibility, to market readiness, acceptance and launch.

If barriers to innovation and market entry are lower, and it is harder for large companies to develop truly new innovations in-house, it would suggest that companies may adjust their innovation mix to become more acquisitive. Poppi is a great example of this in action.

Benefits of Growth Through Acquisition, Rather Than Innovating

The decision to purchase Poppi instead of developing a comparable product from scratch aligns with PepsiCo’s broader corporate acquisition strategy. Here’s why acquiring an established brand made sense for PepsiCo:

- Established brand equity

Poppi is far more than a product formula. It is a recognizable, profitable brand with a strong identity, established distribution, and aligned with consumer trends. It has a set of benefits that are meaningful to a growing health-conscious segment of the population. Poppi can benefit greatly from PepsiCo’s scale to extend awareness and availability to a far broader base of consumers who will experience and enjoy it. - Meeting consumer demand for healthier choices

Consumers have been seeking healthier, more functional benefits across categories. While options from big brands continue to grow, smaller brands and private labels are also gaining traction. Acquiring brands like Poppi aligns PepsiCo with this evolving demand and positions them at the forefront of consumer trends. - Faster growth through acquisitions over research and development

Other big CPG companies like Hershey and Mondelez, among others, have recently acquired brands that point their portfolio in a healthier direction. Corporate CPG merger and acquisition (M&A) departments are growing, which signals that companies are not always willing to wait for their labs to develop the next innovation, and will acquire innovative brands to deliver faster returns. - Scaling small brands without cannibalisation

The better return may just come from a mom-and-pop operation in Anytown, USA. This is why PepsiCo purchased Poppi – they are experts in growing, marketing and selling a brand to new consumers, in new places, for new occasions in new ways. The challenge for an acquiring big CPG firm is to take that small brand and make it a big one, without cannibalizing its existing portfolio. Not a small challenge, but I would argue that PepsiCo’s purchase of Poppi will likely prove to be a very sound investment in a brand poised for significant growth, even though it wasn’t born there.

So, what’s the next Poppi? Join Matt Valle, author of this insight, as he discusses this question on his LinkedIn.

Prepare for the Future of CPG Innovation with Mintel Consulting

The acquisition of Poppi offers an essential lesson for decision-makers in the CPG sphere. Innovation in the industry no longer depends solely on in-house product development. Instead, it’s about recognizing potential disruptors in the field and strategically aligning with them.

For industry leaders, this shift calls for a re-evaluation of current growth strategies.

Is your company leveraging acquisitions as part of its market expansion strategy?

Looking for tailored insights? At Mintel Consulting, we specialize in exploring real-time market data to deliver customised opportunities and recommendations to help propel market expansion and fuel consumer demand. Contact us today, so you can lead in competitive markets.