Consumers are now transitioning back to some kind of normalcy post-COVID, but the global market volatility continues to influence consumer intention and action. In May 2022, 22% of Australian consumers felt that the Ukraine conflict would have a major impact on their household finances, while nearly half (48%) of them said that the situation would lead to an increase in food and drink prices, according to Mintel’s financial tracker research.

As the cost of living soars and supply chain disruptions continue, there is a greater realisation that locally produced products have many advantages, including supporting the local community and economy. Apart from filling in where there may be gaps in imports, this will also help Australian businesses financially push through the current inflationary pressures. Easier online access to local products is already driving the uptake of homegrown brands in Australia.

Aussies choose to ‘go local’

‘It’s never been more important to buy Australian than right now’— was the catchphrase of the promotional initiative from the Australian Made Campaign Ltd in 2020. In Mintel’s Global Consumer research, 54% of Australians say they try to buy locally-grown food. It makes sense, especially during times of uncertainty, where consumers gravitate toward what they know and trust. This stems from their desire to know where their products are coming from and help the local community. For instance, we’ve seen how the awareness of the struggles faced by local sellers has grown during the pandemic, and consumers want to show their support. Furthermore, this spotlights the shift towards self-sufficiency by leveraging the value of Australian made products while balancing them with overseas imports.

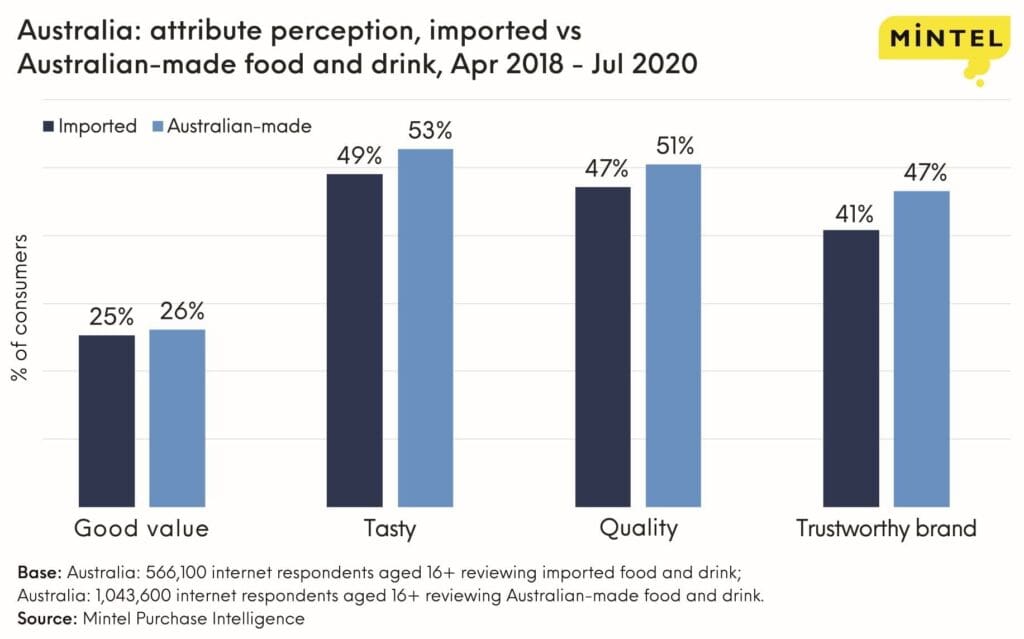

But would consumers pay for Australian made products? Data from Mintel Purchase Intelligence shows that Australians generally believe locally made products deliver on taste, quality and trustworthiness compared to imported products. Price competitiveness is also driving purchase intent, with 40% of consumers saying that it is an important factor when choosing food and drink going forward.

These attributes resonate well with locally manufactured breakfast cereals which make up the biggest proportion of the Australian made food category (75%), followed by baby food (53%) and chocolate confectionery (51%). Others, like packaged fruits and vegetables, are not as well represented, and this gap presents an opportunity for brands to tap into.

Brands need to be bold and trustworthy with their Australian made credentials

Consumers are now looking for transparency (even more so from ingredients), and brands must use that authenticity to build trust. If your brand is made in Australia from Australian ingredients, now is the time to demonstrate the value you bring to the local community (e.g. supporting Australian farmers or Australian jobs).

When analysing consumer purchase reactions using Mintel Purchase Intelligence, clear communication on pack is also important, for example, listing what percentage of Australian ingredients is in the product. On reviewing a French salad dressing from a local brand, one respondent said: “I think less of the design of the packet or product even, I look first at the Australians origin. This says it’s 99% Australian and that makes me far more likely to buy.”

While not all brands can be Australian made, highlighting product quality and heritage can create a point of difference from Australian made products. For instance, Swiss made chocolate brands are ranked highly for their quality among the 161 imported chocolate blocks picked up from Mintel Purchase Intelligence. Educating consumers with unique brand stories will be key for imported products to demonstrate authenticity.

As we enter a post-pandemic world where international supply chains take time to reconfigure, the new-found fondness for buying and shopping local will likely continue. The good news is that opportunities exist to capitalise on this growing appetite for Australian made products.

This article by our Mintel expert originally appeared in Retail World Magazine’s November issue.