A third of Indian parents seek lower-sugar candy for kids, yet local innovation lags

Mintel’s latest research highlights a significant gap between Indian consumer demand and industry innovation in the sugar confectionery space. Although children represent a key audience for candy brands, only 1.5% of new launches feature on-pack claims that explicitly target them, well below the global average of 3.5%.

This shortfall is especially notable given the growing parental scrutiny over children’s diets and preference for healthier treats. According to the report, 34% of Indian parents with children aged 4-12 consider low sugar content a key purchase driver when buying candies, while 30% look for products made with natural ingredients.

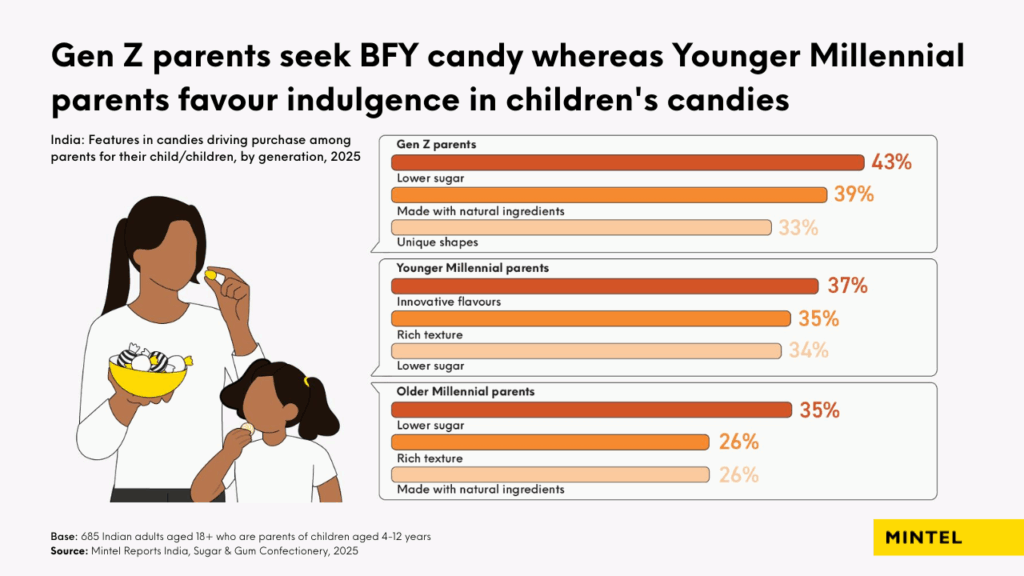

Demographically, Gen Z parents (aged 28 and under) are especially likely to seek better-for-you (BFY) options, emphasising health-focused attributes like low sugar and natural ingredients. In contrast, Younger Millennial parents (aged 29–35) prioritise indulgence, favouring unique flavors and rich textures.

However, India has recorded no new launches of low/reduced sugar candies in the past five years, even as such products—though still niche—account for 1.2% of global launches. This gap highlights a missed opportunity for Indian brands to address evolving parental preferences.

“While low sugar ranks slightly lower for Younger Millennials, it remains a key consideration across both age groups,” said Mintel’s Tulsi Joshi, Principal Food and Drink Analyst, India. “This growing health-consciousness among parents presents an opportunity for Indian confectionery brands. By drawing inspiration from global markets, they can introduce innovative, healthier candy options that appeal to the next generation of parents and their children.”

The report also highlights a shift in brand positioning around natural claims. In India, while “no nasties” (such as no additives/preservatives and “free from” claims) dominate, “all natural” claims have grown from 1% to 7% of launches over the past five years. This growth outpaces that of “no nasties” and signals a move toward more holistic, natural-led positioning.

“As natural ingredients are the second-most important factor for parents—after low sugar—brands can carve out a distinct space by prioritising ‘all natural’ positioning,” Joshi added. “This also means encouraging parents to see kids’ candy as a fun treat, with a little less guilt attached.”

-

Discover your next big breakthroughGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View Reports

-

2026 Global PredictionsOur Predictions go beyond traditional trend analysis. Download to get the predictive intelligence and strategic framework to shape the future of your industry in 2026 and beyond. ...Download now

-

Are you after more tailored solutions to help drive Consumer Demand, Market Expansion or Innovation Strategy?Ask for a customised strategic solution from Mintel Consulting today....Find out more