For decades, nutritionists, physicians, and scientists have warned against the detrimental effects of sugar on health and have cautioned against overconsumption. For much of this period, consumers ignored the advice and indulged in sugary treats of all varieties, satisfying their cravings while compromising their long-term well-being. However, over the last several years, there has been a notable shift in consumer behavior: demand for low-sugar products has increased dramatically as consumers heed the advice of health professionals and take action to prioritize their long-term health by reducing sugar intake.

Broad demand for low sugar is driven by health aspirations

According to Mintel research, nearly three in five consumers are choosing low-sugar products for their general health. The low-sugar market, strictly defined in as products that contain 3g or less of sugar per serving, has scaled rapidly behind consumer demand across both food and beverage. Specialized diets play a limited role in low-sugar decision-making compared to overall health aspirations.

There are many more products claiming to be low in sugar (“sugar reduced by 25%”; “30% lower than the leading brand”) that contain higher levels than the standard, but these have been excluded from the market analysis to illustrate the extent to which consumers are looking to reduce sugar consumption.

Natural sweeteners are gaining favor with consumers

As more consumers look to reduce sugar, many of them are seeking natural alternatives. More than two-thirds of consumers agree it is essential that sugar or sweetness comes from natural sources. The naturally sweetened low-sugar market is nearly four times larger than the artificially sweetened low-sugar market. While low-sugar products of all formulations are growing, naturally sweetened low-sugar products are growing faster than artificially sweetened products.

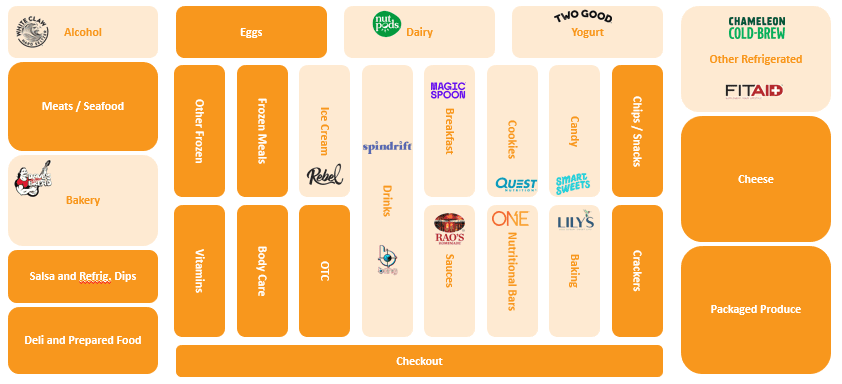

Gaining share across aisles

Historically, low-sugar products catered to weight loss programs and diabetic consumers, and therefore, were featured in pharmacy aisles away from everyday food and beverage consumer traffic. In recent years, mainstream consumers prioritizing health have started to demand low-sugar alternatives across nearly all aisles of the store. Where available, low-sugar products are growing faster than their higher-sugar competition, claiming meaningful market share and illustrating the significant demand for low-sugar products. The diagram below highlights aisles in the grocery store where low-sugar product growth is outpacing higher-sugar alternatives.

Innovative brands leading with low-sugar

One of the earliest categories where low-sugar innovation first gained traction was wellness bars, where low-sugar brands such as Quest and One Bar gained market share by providing delicious, healthy alternatives to category incumbents. Today, low-sugar products account for over 33% of all wellness bar sales and growth continues to outpace higher-sugar wellness bars, suggesting that market share gains will continue.

Several categories analogous to wellness bars such as cookies, chocolate candy, and non-chocolate candy, among other sugary indulgences, are all in the early stages of innovation with low-sugar products accounting for less than 5% of the categories. Notable low-sugar brand, Lily’s Sweets, produces chocolate products that are low-sugar in both chocolate candy and baking, with a mission to deliver delicious chocolate with natural sweeteners and no added sugar. Lily’s Sweets products started in the candy aisle of natural food stores and can now be found across the country in candy and baking aisles at grocery stores and mass retailers.

What we think

Between the mainstream consumer appeal of low-sugar products and the entrance of innovative brands bringing high-quality options to market, there is significant opportunity ahead for the low-sugar market. Mintel estimates the low-sugar market could add an additional $36 billion in the next three years, continuing the recent growth trajectory and gaining market share across food and beverage.