The plant-based revolution has started, but is it here to stay? Discover the latest growth opportunities and innovations in the plant-based sector.

The plant-based market

Over the last decade, the explosion in all things plant-based has been immense. First coined as a term in the 1980s, “plant-based” didn’t surface seriously on the world stage until 2015. With increasing concerns about health and climate, consumer interest in both plant-based diets and plant-based lifestyles has driven a wave of product innovation in the plant-based industry around the world. Data from Mintel Global New Products Database highlights that consistent growth, the number of new packaged consumer goods launched with a plant-based claim has increased by 302% between 2018 and 2022. Mintel analysts forecast that the market could grow to $160 billion by 2030. It’s safe to say that plant-based is now a lifestyle choice, and it’s here to stay.

What does plant-based mean?

Put very simply, plant-based refers to any consumer goods that are derived from plants. In the main, this means fruit, vegetables, grains, pulses, nuts, oils, seeds, spices and plant-based extracts. This already extensive list has recently expanded to include upcycled apricot kernels. Consumer concern over planetary environmental health and human health are the key driving factors behind the plant-based food trend. Plant-based innovations are making a splash in consumers’ daily diets, such as plant-based meat substitutes/alternatives, plant-based dairy alternatives and plant-based fish/seafood alternatives. We also see plant-based claims in beauty and personal care products, household, fashion and apparel categories.

Are plant-based and vegan the same thing?

While they are similar, they have some key differences. Vegan diets eliminate all animal products, while plant-based consumption does not necessarily eliminate animal products and proteins, they instead reduce the consumption of animal-based ingredients and focus on eating more plant-based goods such as vegetables, fruit, nuts etc.

Plant-based brands have previously tapped into the vegan market but are now keen to have a more mainstream appeal focusing on flexitarians and omnivores, rather than pursuing a small segment of vegan consumers.

The impact of inflation on the plant-based market

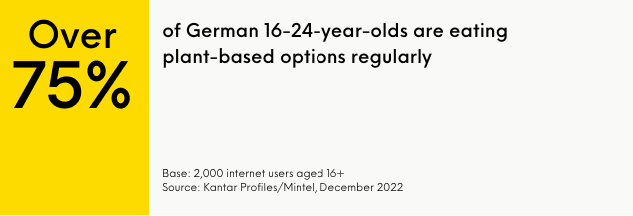

There’s little doubt that interest in the plant-based food and drink industry is strong, and the long-term outlook is positive. Over three-quarters of German 16-24-year-olds are eating plant-based options regularly. However, the recent economic downturn has caused some consumer interest to wane. After a rapid rise, the market finds itself facing a challenge in the short-term.

Consumers are beginning to feel uneasy about their personal finances and are turning away from purchasing expensive plant-based meat alternatives. You only need to look at the recent sales slump experienced by Beyond Meat. Our industry analysts believe that the meat alternatives market is in a weaker state than a year ago due to the pressure on household finances.

But it’s not all bad news, our analysts also believe the growth will revive at some point. The plant-based movement is likely to regain momentum once consumers begin to feel more positive about their finances. Additionally, awareness of the plant-based industry’s sustainable credentials and positive impact on climate change should underpin demand in the long-term.

How can plant-based brands stand out in a crowded market?

Focus on quality

Brands can focus on promoting desirable qualities, such as fruit/veg content and high protein. Protein is a key opportunity as the majority of plant-based consumers would like to see more high-protein plant-based dairy alternatives, according to Mintel’s research on plant-based food trends. Food and drink companies have an opportunity to appeal to the large percentage of consumers who want to explore vegan alternatives and add fruits, vegetables and grains into their diets – support consumers who are looking for pro-plant diets, not necessarily vegan.

Diversify plant-based protein sources

Improved variety in plant-based proteins is key for sustained market growth. Types, formats and sources of plant-based protein innovation will also continue to diversify in order to meet consumer demands for realistic alternatives to both meat and dairy. As one of the most popular plant-based products, the high use of burger substitutes has much to do with their availability and the innovations brands have made in both taste and texture. Brands can find ways to stay ahead of the competition by elevating new alternative formats to other types of meat products in the way that Impossible Foods and Beyond Meat did with burgers.

Plant-based food trends – what’s next?

Consumer interest in plant-based seafood innovations is growing, driven by ongoing concerns about the environmental impact of commercial fishing. 60% of UK meat-substitute consumers find plant-based seafood products more appealing having seen negative news coverage of sea fishing. Fish substitute products are in a good position to be presented as a sustainable solution to challenges in the seafood industry.

Over a fifth of Brazilian consumers are interested in milk substitutes designed for athletic recovery. This speaks to an increasing consumer demand for products that tap into functional health. There is a growing opportunity for brands to innovate with functional ingredients, and promote the beneficial aspects of non-dairy drinks.

In China, 15% of consumers consume plant-based beverages daily, while over half consume dairy milk daily. There are opportunities for plant-based dairy brands to increase market share and widen the consumer base. More than half of consumers would like to try plant-based drinks with multiple plant protein sources, so brands should focus on product innovation with plant ingredients that consumers are interested in, such as black bean, pistachio, and cashew.

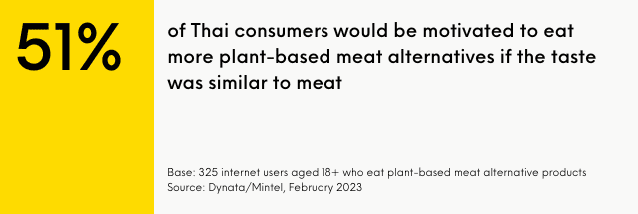

51% of Thai consumers would be motivated to eat more plant-based meat alternatives if the taste was similar to meat. So in order to appeal to a wider consumer base, plant-based brands must focus on innovating and creating meal alternatives that successfully mimics the taste and texture of animal meat.

Contact our experts

Mintel’s leading food, drink and retail experts have conducted market research to identify global trends, growth opportunities and evolving consumer attitudes towards plant-based trends. To gain further insight and expert analysis, browse our food, drink and retail market reports on the Mintel Store. Alternatively, fill out our contact form, and an industry specialist will be in contact.