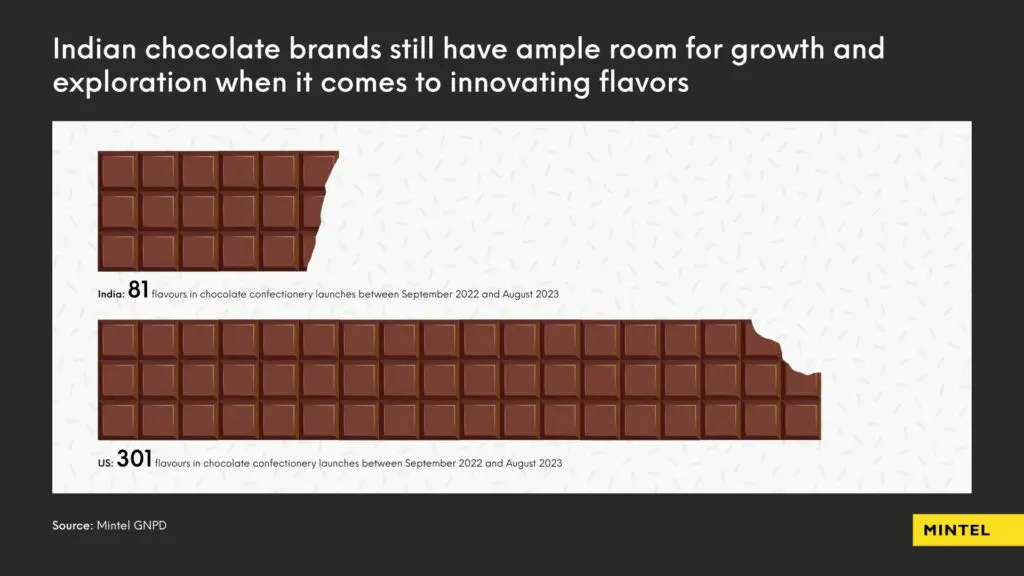

In recent years, chocolate consumption in India has seen significant growth, with a sizable portion of consumers embracing this indulgent treat. Mintel research shows that six in 10 Indians have consumed chocolates in the past three months through June 2023, with a notable percentage expressing interest in trying new flavours. Despite this burgeoning interest, there remains untapped potential in flavour innovation within India’s chocolate market. For example, flavour innovation in chocolates in the US is approximately 3.7 times higher than in India.

Here, we delve into the opportunities for flavour innovation in chocolate confectionery, examining the appeal of traditional Indian flavours, such as mithai, and the emergence of fruity variations.

Leverage the interest in mithai flavours

Traditional Indian sweets, known as mithai, hold a special place in the hearts of many Indians. Mintel research shows that one-third of consumers express interest in mithai-flavoured chocolates compared to international dessert flavours, thus presenting a promising opportunity for brands to cater to local preferences.

By infusing chocolates with flavours reminiscent of beloved mithai such as gulab jamun, rasgulla, and jalebi, brands can offer a modern twist on traditional delicacies. Moreover, the introduction of limited edition assortment packs inspired by mithai flavours can further enhance consumer engagement and excitement.

It’s also essential for brands to recognise the diverse preferences across different regions in India. While flavours like gulab jamun may resonate more with consumers in the West, those in the East may prefer rasgulla. Understanding and catering to these regional nuances can strengthen brand appeal and ensure broader market penetration.

Furthermore, drawing inspiration from local mithai stores that have successfully integrated desi flavours into their offerings can provide valuable insights for chocolate brands seeking to tap into regional tastes. For instance, local brand Bombay Sweet Shop introduced the Indie Bar, featuring layers of pepper caramel, coconut fluff, patissa/soan papdi (a local sweet delicacy), and dark chocolate. According to the brand’s website, its chefs experimented with soan papdi and recognised its potential for inclusion in a chocolate bar.

Expand offering of fruity variations

Fruity flavors are mainstream in India’s chocolate market, with 18% of product launches featuring fruity variations. Brands can capitalise on this by introducing seasonal fruity variations, as seen in markets such as Germany, the UK, and Japan.

Mango is emerging as a particularly sought-after flavour. The recent launch of Cadbury Dairy Milk’s tangy mango flavor exemplifies this trend, leveraging nostalgia and seasonal appeal to captivate consumers. A niche segment of experimental consumers are also interested in trying flavours like apple, guava and pineapple – further diversifying the chocolate flavor landscape.

Brands like YBC Nago Me Time Spice & Chocolate Apple & Cinnamon Chocolate (Japan) showcases unconventional fruity combinations such as apple and cinnamon to capture the interest of consumers.

What we think

The relatively limited number of flavour launches in India compared to other markets presents a ripe opportunity for both existing and new brands to establish themselves as flavour specialists. By embracing local tastes, exploring regional variations, and experimenting with novel flavour combinations, they can cater to diverse consumer preferences and carve out a distinctive niche in this increasingly competitive chocolate landscape. There remains abundant potential for creativity and exploration in the realm of flavour innovation, and this will remain a key driver of growth and market differentiation.