Consumers are seeking a balanced approach to diet and health, recognizing that occasional treats are essential for enjoying life and managing stress. In a category centered on indulgence, Halo Top has taken market share by proving that consumers can have it all—taste, indulgence and health.

US ice cream fans want more than indulgence

Halo Top offers both treat appeal and health appeal, combining a fun brand image, enticing flavors and significantly lower calories compared to premium ice creams.

The brand prominently communicates the calorie count and protein delivery on the tubs; a distinctly transparent approach which consumers have welcomed. Halo Top tubs range from 240 to 360 calories per pint, with 20g of added milk protein, compared to 20g protein, but over 1,000 calories and 76g of sugar in a pint of Häagen-Dazs chocolate ice cream.

Halo Top’s shrewd use of social media has taken it to a different level. Boasting nearly 700k Instagram followers, Halo Top’s digital marketing strategy seems to be working.

When asked why they would buy Halo Top, US consumers shared the following:

- “I am usually interested in frozen products and it looks like it might taste good. It is a good source of protein, and not too many calories.” – Female, Midwest, aged 55+

- “I have actually bought this product – great alternative to other ice creams in terms of calories/nutritional value and flavor is great.” – Female, Northeast, aged 18-34

Halo Top shakes up the US ice cream market

Halo Top’s ‘permissibly indulgent’ ice creams have recorded growth with a low calorie, added protein recipe in a category entrenched in indulgence, catching its larger rivals, Unilever and Nestlé, off guard. Halo Top is reported to have recorded a sales growth of 2,500% between 2015-16, to reach $66 million in 2016.

Its fame truly rocketed when it outsold ice cream giants like Unilever and Nestlé Dreyers to become the best-selling ice cream in the US over a four week period in July 2017.

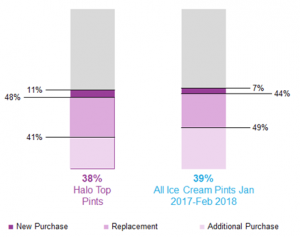

According to Mintel Purchase Intelligence, Halo Top Pints perform on par with the Ice Cream Pints Benchmark on overall purchase intent. But Halo Top is more likely to attract new users to the category—11% of those with positive purchase intent claim that this would be a new purchase.

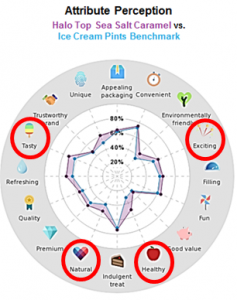

Sea Salt Caramel flavor drives ‘unique’ perception

Halo Top Sea Salt Caramel flavor outpaces the all ice cream pints benchmark on tasty, exciting, natural and healthy attributes, resulting in a high purchase intent score.

When asked why they would buy Halo Top Sea Salt Caramel, US consumers shared the following:

- “Sea salt caramel is one of my favorite flavors. Halo Top ice cream is a brand I hear about all the time and is highly recommended!” – Female, Midwest, aged 18-34

- “The packaging makes it look like a premium product. The flavor is also rather exotic and is rather unique among retail ice creams.” – Male, West, aged 18-34

What we think

Our research shows that ‘permissibly indulgent’ ice cream resonates with consumers across demographics, suggesting scope for additional category growth. Brands have an opportunity to excel by offering consumers ‘permissible indulgence’ that walks the line between health and indulgence.

Halo Top has disrupted the ice cream category by offering premium pints with low calorie/high protein formulations. Ice cream giants have taken note of Halo Top’s success, responding with similarly positioned low calorie/high protein offerings. Ice cream brands should consider the use of traditional and top-selling ice cream flavors in ‘permissibly indulgent’ formulations for mass appeal.

Mintel Purchase Intelligence combines consumer research data with new product data for all food and drink products found in Mintel Global New Products Database (GNPD) since January 2016. To learn more visit mintel.com/mintel-purchase-intelligence.