-

Articles + –

Soy, the original plant protein, needs a makeover

Looking back, the vegan revolution has started with one particular key ingredient: soy. Fast forward a few years, new innovations are now made of a multitude of plant-based protein sources such as pea, hemp, oat and rice, to name a few. Although soy has long been a leading plant protein, it is challenged by health and environmental concerns, as well as competition from newer plant proteins that are positioned as plant-based, sustainable, and non-GMO.

In Germany, for example, 2 out of 5 consumers who have not eaten meat substitutes agree the use of soy in meat substitutes products puts them off trying them. Yet, soy offers a range of benefits producers and brands can tap into. Here, we explain how innovators can tackle these concerns and challenges and promote soy’s benefits.

Tackle concerns with certified soy

For consumers who are wary of soy for ethical or environmental reasons, transparency regarding soy’s provenance and agricultural practices is a must.

Heüra Bocados Mediterráneos (Mediterranean Bites) are made with non-GMO soy from cultivations that do not encourage deforestation, water, olive oil and spices, and is high in protein and iron. The 100% plant-based product is free from gluten and artificial preservatives, and suitable for coeliacs. It scores an A on the Nutri-Score scale and retails in a newly designed 160g recyclable and sustainable tray pack made from recycled materials. (Spain)

Emerging from the GMO debate is the presence of herbicide residues, specifically glyphosates. Glyphosate residues are making headlines with high levels found in coffee and other foods. Concerns about the herbicide have led some companies to take steps to remove it from their supply chain. For instance, Kellogg’s announced that it is working with suppliers to phase out glyphosate as a pre-harvest drying agent on wheat and oats by the end of 2025.

Although very few products make glyphosate-free type claims, unified labelling schemes are emerging – as seen in the US with Detox Project’s Glyphosate Residue Free and BioChecked certification. The Detox Project’s Glyphosate Residue Free certification is positioned as complementary to organic and Non-GMO Project claims.

Promote protein quality

Protein quality can be a point of differentiation for soy, as it contains all nine essential amino acids. Soy has been losing its status as the go-to plant protein over the past 20 years as new innovations bring alternative plant-proteins to the market.

Consumers need more education about the protein benefits of soy. For example, even though soy milk contains more protein than almond milk, only around a quarter% of US milk consumers think soy milk is a good source of protein while nearly three in ten agree almond milk is a good source of protein.

High/added protein claims are starting to increase on soy-containing products, but there are more opportunities to position soy as a high quality plant protein too.

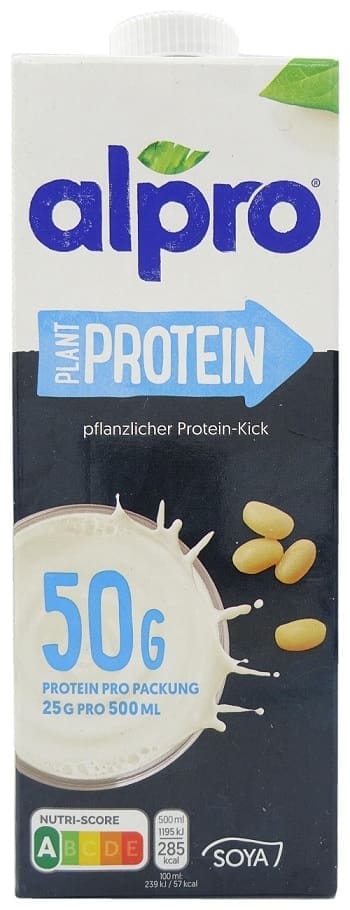

Alpro Plant Protein Sojadrink (Soy Drink) has been repackaged. The UHT product is said to provide a plant protein kick and is rich in plant proteins, containing 50g protein per pack. Protein supports the growth and maintenance of muscle mass. The drink is also enriched with calcium and vitamins, and is a source of vitamins B2, B12 and D. It is low in sugar and saturated fatty acids, and free from lactose, gluten and GMOs. It can be enjoyed pure or used in porridge, cereals, smoothies or shakes. (Germany)

Appeal as a budget-friendly plant protein

Companies are being challenged to make plant-based products more affordable and accessible. One of the reasons soy has been commonly used in food and drink products is because it is an affordable source of plant protein. There are opportunities to leverage soy as a value-conscious protein.

Reports have found soy is an affordable protein source, especially when protein quality is accounted for. In APAC, soy milk is still the most cost-efficient and widely distributed plant-based drink. Within the APAC region, soy milk is often priced competitively against UHT milk, whereas soy alternatives, such as almond milk, are usually imported and are often sold in premium supermarkets at a relatively high price.

Price is a barrier for plant-based consumers in other markets and categories as well. In the US, for example, over half of dairy alternative consumers think dairy alternatives should be more affordable than traditional dairy. Meanwhile in Europe, half of consumers who don’t use meat alternatives in France, Spain and Germany think meat alternatives are overpriced.

What we think

Soy needs to clearly communicate benefits in order to appeal to consumers who have a wide range of options for plant-based protein today. Soy is uniquely positioned to be utilized as a high quality and affordable plant protein, especially as plant-based and flexitarian diets gain more traction. Certified soy with traceable provenance and transparent agricultural practices will be necessary to win back consumers who may be wary of soy for ethical or environmental reasons.

Stephanie Mattucci is the Associate Director, Food Science at Mintel. Prior to Mintel, Stephanie worked as a food scientist in R&D for an ingredients company.

-

Mintel StoreGet smart fast with our exclusive market research reports, delivering the latest data, innovation, trends and strategic recommendations....View reports

-

Mintel LeapMintel Leap is a revolutionary new AI-powered platform that will transform your research process....Book a demo