In 2024, global CPG innovation reaches an all-time low

Consumer Packaged Goods (CPG) companies are understandably obsessed with what the near future will look like. However, to quote the US computer pioneer Alan Kay, ‘the best way to predict the future is to create it’. Mintel’s analysis shows that such creativity has been in short supply in recent years, and this innovation drought risks the future profitability, and potentially, even survival, of established CPG industry players.

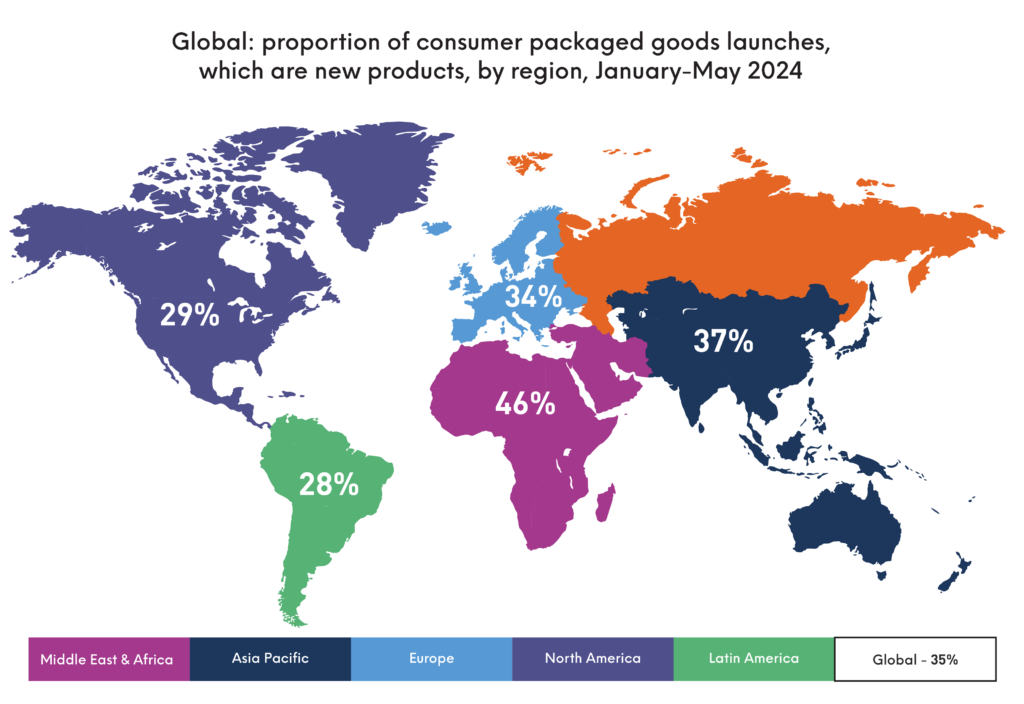

Mintel’s Global New Product Database (GNPD) shows that for the first five months of 2024, just 35% of global CPG launches (i.e. across food, drink, household, health, beauty, personal care and pet care) are genuinely new products. This is the lowest proportion of innovation Mintel has recorded since it began tracking new products in 1996. It means that so far in 2024, 65% of launches are ‘renovation’ i.e. line extensions, reformulations, new packaging or relaunches.

Declining innovation comes at a time when big brands have just pushed through significant price increases, in many cases without offering consumers any additional benefits. This makes it easier for consumers to switch to private-label alternatives. For example, in May 2024, almost a third (31%) of US adults admitted to buying more store brands over the past two months. Will those consumers automatically return to big brands once they feel more financially confident?

CPG Industry Challenges: Innovation falters in the Americas

While every region has seen a decline in CPG innovation, the trend is most pronounced in North and Latin America. Even in the US, home to the innovative Silicon Valley, only 29% of CPG launches are new products for the first five months of 2024, well below the global average.

In contrast, the Middle East, Africa and Asia-Pacific are the regions innovating the most in the CPG industry, a reflection of their faster rate of economic growth than more mature markets, and fuelled by a more entrepreneurial ‘growth’ mindset. For example, the latest IMF economic forecasts predict emerging and developing Asia will grow by 4.9% in 2025 and the Middle East, Asia and Central Asia by 4.2%, whereas advanced economies are estimated to grow by just 1.8%.

COVID-19 is not to blame

Why is innovation now firmly in the minority? COVID-19 certainly did not help. It disrupted the ability of research and development (R&D) teams to collaborate face-to-face and in the lab. COVID-19 delivered (along with the Ukraine war) a shock to the global economy which forced companies onto the defensive. When you’re constantly having to support businesses by reformulating products to keep up with increasing ingredient costs, raw material shortages, and downsizing, there is little time left for blue-sky thinking. From a consumer perspective, anxious shoppers have also been more concerned about getting value for money, than discovering new and exciting products. As Domino’s CEO Russell Weiner recently told the Wall Street Journal, “consumers just don’t want surprises.”

As a result, total CPG innovation declined from 42% in 2019 (the year pre-COVID-19) to 35% in the first five months of 2023. However, this rate of decline is no worse than between 2013 and 2019. The decline in true innovation dates much further back. For example, in 2007, the year before the global financial crisis, just over half of global CPG launches were new products. A decade later, this share of innovation had declined to 43%.

CPG Industry Trends: Bigger no longer equals better

After the shock of the 2008-9 global financial crisis, larger CPG companies may have consciously decided to innovate less because of concerns about return on investment. After all, Harvard Business School professor Clayton Christensen, who developed the theory of “disruptive innovation”, found that of the 30,000 or so new products introduced each year, 95% of them failed. However, a lack of R&D investment from bigger brands post-financial crisis created the environment for startups such as Harry’s razors, OLIPOP, Documents and Glossier, to tap into the rise of digital technology and gain a foothold in their respective categories. McKinsey has analysed Nielsen data to show that between 2016 and 2020, only 25% of the growth of CPG was driven by leading brands, with small and medium-sized brands capturing 45% of growth and private label, 30%. To be more disruptive, major CPG companies have increasingly created in-house venture capital units that invest in young companies, helping them to grow in exchange for insights into new consumer trends and their agile business models.

Food and drink innovation falls by almost half

When comparing different CPG industries, innovation has declined the most in food and drink, which launched just 26% of new products between January and May 2024 compared to 50% in 2007. Food and drink companies have preferred to launch new varieties/range extensions or new packaging, as a way to offer new, but familiar, choices to consumers. According to Mintel’s Director of Food and Drink Jonny Forsyth, ‘most of the innovation over the past two decades has come from the eCommerce channel. However, food and drink manufacturers have to cope with complex supply chains, low margins and the need for temperature control when delivering fresh food and drink. The barriers to entry are therefore much greater than if you are starting a business in categories like beauty and personal care, household goods or vitamins and supplements.’

Beauty brands rethink their business models

Clotilde Drapé, Global Beauty and Personal Care Analyst, explains that BPC brands have also witnessed a slowdown in launch activity compared to pre-COVID levels. While beauty companies tend to have lower barriers to entry than food and drink companies, they are also facing their share of difficulties. Higher costs of raw materials, stronger consumer scrutiny around ingredients and income squeezes have led beauty brands to rethink their business models over the past few years.

For well-established brands, reformulations and range extensions are a safe investment as consumers are already familiar with their lines of hero products and the companies are able to invest in campaigns that bring a sense of newness to the launches. However, innovation differs regionally. The Middle East and Africa region are seeing growth in new innovations thanks to the emergence of local brands, while other regions such as Europe and North America struggle to recover to pre-COVID innovation levels. Local brands in the Middle East compete with international brands by speaking directly to local consumers’ cultural heritage as done by SimiHaze Beauty in the Middle East.

For established market players in European countries, it can take longer to take a new product to market due to heightened consumer scrutiny around ingredient transparency (69% of French adults agree that beauty brands should provide more scientific evidence to validate the claims they make) alongside strict regulatory compliance. Prestige brands especially need to navigate innovation even more carefully as any backlash could cost up to millions to a brand and hurt consumer trust. This was acutely felt by Guerlain and their new Orchidée Impériale cream, which said it used “quantum science” and had to publically clarify the term to avoid “science-washing” criticism.

Big brands face an upcoming wave of innovation competition

As the digital transformation of CPG gathers pace, the old adage ‘innovate or die’ will never be truer, especially given that big brands have been growing more slowly than challenger brands and private-label. If big players fail to innovate more, this trend will dramatically increase as we enter the late 2020s.

This is because the rapid emergence of Artificial Intelligence (AI) and eCommerce have lowered the barriers to entry for smaller, direct-to-consumer brands, who can build their brand equity and sales online, develop a detailed understanding of their consumer, before pivoting into physical retail where they have a greater chance of success.

AI means that being smaller is less of a disadvantage because algorithms can help augment innovation, create marketing campaigns, develop consumer insights and support customer service. The Hungarian energy drink Hell is an example of how AI can be leveraged to help create and advertise a new product. It does not mean humans will cease to be important, but that startups can grow with smaller teams. As the AI improves, so will such launches become more sophisticated.

The rise of AI means bigger CPG brands are now operating in a ‘real-time world’. Innovation cycles that previously took years can now take just months, and algorithms can make sense of a dizzying array of new digital data points as they happen. As a result, bigger brands need to become more agile and faster to win the race for ‘white space’. This also has implications for how research companies must operate. Mintel’s launch of the industry-first AI search platform has transformed research processes. Using Mintel’s vast proprietary data and human insight, Mintel Leap delivers the answers clients need with unparalleled speed, quality and accuracy.

Private-label will be a key threat to big CPG brands

Recessions are often a catalyst for startups, and were it not for the rise in global interest rates, the CPG industry would likely have faced a wave of new challenger brands pioneered by participants of the post-COVID-19 “Great Resignation”. However, the decision by the European Central Bank (ECB) in June 2024 to cut European interest rates for the first time in five years fires the starting gun for central banks throughout the world to begin rolling back high interest rates. Meanwhile, falling inflation means that consumer confidence and optimism are on the rise. Mintel’s consumer tracker for May 2024 shows that 37% of US adults feel they are better off than a year ago, and 36% of British adults feel ‘pretty confident I’ll be OK’. If inflation and interest rates continue to decline, expect big brands to face far more disruption in the late 2020s, and for consumers to be much more optimistic and open to new products offering different benefits.

The second major threat to big brands will come from private-label. AI is helping to accelerate the digitisation of supermarkets. For example, facial recognition cameras are now able to analyse shopper behaviour and body language in Japan, while clubcard memberships, online shopping apps and AI-powered ‘Smart carts’ are just some of the ways supermarkets can now access a treasure trove of new digital data points.

Supermarkets can – and surely will – use AI algorithms to harness this big data so they can create better private-label products at more competitive prices. Innovation will be a central pillar for bigger CPG brands to survive, and thrive against such challenges as we enter the second half of the 2020s. The time to innovate is now.

Meet the ‘What’s next team’…

…and identify opportunities to propel innovation

When it comes to launching winning innovation, sometimes you need to look at the data in a whole new way.

That’s where we come in. At Mintel Consulting, we’ll help you understand your consumers, analyse your competitive landscape, identify emerging product trends, and determine the optimal launch strategy for maximum impact. We’ll uncover current and future market opportunities to provide you with the insights you need to succeed.

Get in touch today with Mintel Consulting to learn more about how we can use our methods to help drive your growth strategies.

Want to see more? Download the full PDF here

* all fields are required