The luxury retail market is at a turning point. The sector is facing challenges due to slowing global demand, shifting luxury consumer behaviour, and rising expectations around digitalisation, sustainability, and inclusivity.

The challenge for luxury retail brands will be to maintain exclusivity while adjusting to a new price sensitivity, and evolving to meet the needs of younger, more diverse luxury consumers.

This article explores the top luxury retail trends shaping the future of this sector across Europe, the US, and Asia.

Changing Economic Currents Are Impacting Luxury Retail Trends

The luxury retail market is moving beyond the pandemic-era surge, when consumers accumulated surplus capital due to travel limitations, and were able to redirect this towards luxury purchases. While the sector faces economic headwinds with brands competing more intensely for a smaller pool of affluent buyers, the outlook isn’t entirely negative. The luxury retail market is expected to restabilise between 2025 and 2029 as younger luxury consumers build wealth and continue to prioritise spending on experiences and labels that align closely with their personal identities and values, and moderate growth is expected from 2029 onwards.

What strategies are luxury retail brands using to maintain exclusivity?

There are a number of key luxury retail trends and certain product categories that keep the luxury retail segment afloat in the current economic climate:

1. Affordable luxury and entry-level categories speak to new luxury consumers

Beauty and personal care remain an accessible entry point for many luxury consumers, with nearly 75% of adults in the US perceiving luxury beauty as an investment in their appearance.

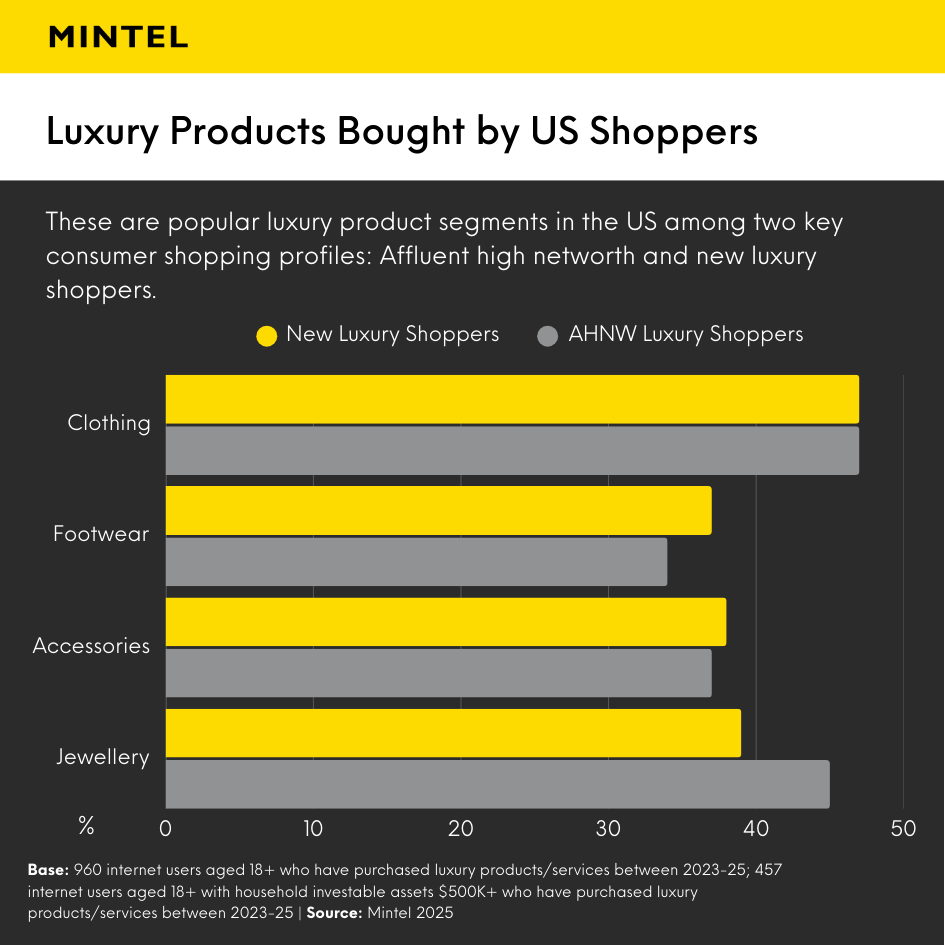

Moreover, apparel, footwear, and accessories also continue to draw new shoppers, because these categories offer lower price points compared to high-ticket items. Meanwhile, jewellery and watches stand out as investment pieces among more affluent consumer groups.

2. Luxury consumers value experience over ownership

Luxury consumer behaviour shows that experiences are increasingly prioritised over ownership, boosting the luxury dining, travel, and immersive events categories. The value of experience goes beyond the purchase of specific experiences and extends to the purchasing of goods: The in-store journey or digital engagement can be a true differentiator and key purchase factor. The in-store and post-purchase experiences can be enhanced through invitation-only events, VIP access, and exclusive services that help cultivate community and reinforce exclusivity. Private members’ clubs, like Harrods’ Shanghai club, and appointment-only formats such as Gucci Salon, provide high-net-worth clients with a level of access and intimacy that defines the tastes of modern luxury consumers.

3. Exclusivity can be retained in luxury retail through a scarcity mindset

Offering limited edition collections and one-of-a-kind items is a key strategy. These products create a sense of rarity and drive demand. For example, in 2022 Louis Vuitton Moët Hennessy’s offered hyper-curated, unique items with exclusive experiences, such as private presentations and bespoke fittings by launching heristoria.com. Mintel’s consumer research shows that a significant proportion of luxury consumers across the US, Europe, and China are more likely to purchase if an item is from a limited edition collection.

Social media has become a valuable tool for brands to create scarcity and excitement through exclusive online product drops, private virtual communities, and influencer partnerships.

In an increasingly digital world, physical retail is evolving into a stage for immersive brand storytelling

The use of online stores and spaces for research may have become an integral part of the purchasing journey, but the store experience remains key. Therefore, flagship stores remain important and can help elevate customer satisfaction in the luxury retail segment. Household names like Tiffany and Dior have grasped the importance of their in-store experience, with Tiffany’s New York store re-opening in April 2023 after several years of renovation. The significant investment in the brick-and-mortar store introduced LED walls, salons, a restaurant and an exhibition space.

Prior to that Dior revealed a sweeping renovation of its Avenue Montaigne complex in Paris, aiming to combine six buildings into a 10,000 sq m complex featuring couture salons, a spa, rooftop gardens, a restaurant and pastry shop, and the world’s biggest fashion museum dedicated to a single designer.

Which Key Demographics and Consumer Groups are Buying Luxury Products in 2025 and Keeping the Luxury Retail Market Afloat?

Urban Dwellers

Urban residents are particularly active in the luxury retail market, especially in categories such as home appliances and furnishings. The notable trend in luxury retail of the growing investment in home upgrades can be accredited to this consumer group. Their access to premium shopping environments and experiential retail spaces reinforces their strong representation among luxury consumers. This reflects a broader shift in luxury consumer behaviour, as people look to elevate their living environments with premium products.

Gen Z and Millennials

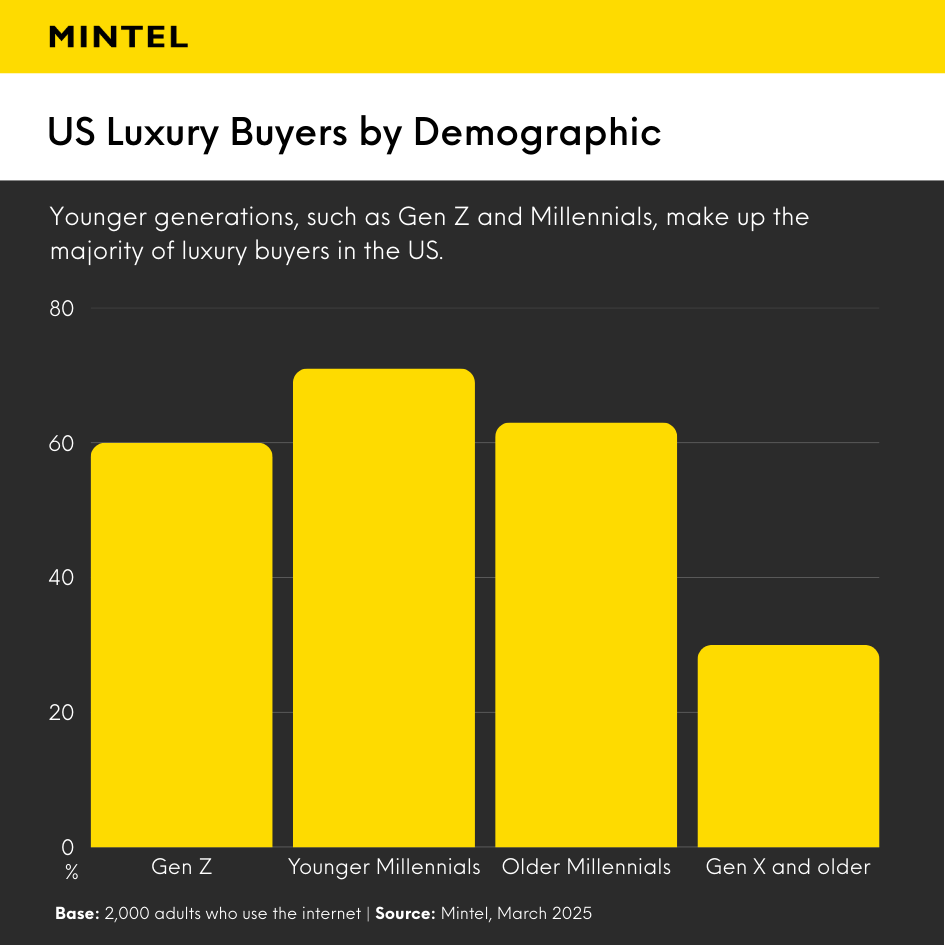

Gen Z and Millennials are now the primary drivers of luxury retail trends in the United States. The Millennials who are currently in their peak earning years wield strong purchasing power, while Gen Z, despite having less disposable income show the highest aspirations and future intent to buy luxury goods. Mintel data highlights this momentum: Gen Z and Millennials are expected to make up 80% of the global luxury market by 2030. In China, Gen Z are persistently and exclusively pursuing their favourite luxury brands and they refuse to settle for less. A striking 60% of them are ready to delay their purchase. They would rather save up to buy from the luxury brand they truly like, instead of downgrading their brand choice due to budget constraints.

How are Gen Z and Millennials reshaping luxury retail expectations?

Gen Z and Millennials are now the driving force of the luxury retail market. While Millennials bring purchasing power, Gen Z represents aspiration and future demand. Together, they are redefining luxury consumer behaviour in these four ways:

Luxury beyond price and status

While price and prestige have long been key to defining what a luxury brand or product is, younger shoppers are looking beyond these features and perceive luxury to be tied to quality, uniqueness, and self-expression. Luxury is less about status symbols and more about individuality and emotional connection. Offering personalisation and opportunities to co-create can incite interest among younger generations, who have a primary interest in expressing their individuality, looking for luxury goods and experiences to reflect that. Bespoke products, customisation, limited editions, and opportunities to co-create with brands resonate strongly, highlighting the shift in luxury consumer behaviour toward a personalised demand.

Viome, for example, offers a monthly toothpaste subscription with ingredients customised to the users’ oral health needs based on a saliva test.

Social Influence

As digital natives, Gen Z, in particular, are quick to adopt trends and expect brands to be agile and culturally relevant in how they position themselves. Social media, influencers, and celebrity partnerships, therefore, strongly shape preferences. Social commerce is already proving its effectiveness for lower-priced products that encourage spontaneous purchases. The fashion and apparel categories are particularly poised to make use of social media as a tool in luxury retail, with 30% of German Gen Z expressing a preference for luxury fashion. However, its reach can be extended to other categories, such as beauty and technology.

What Role Does Sustainability Play in Luxury Retail Strategies Today?

While Gen Z and Millennials show a particular affinity for sustainable and ethical luxury retail, sustainability has quickly become a strategic pillar across all consumer groups and categories in the luxury retail market. Mintel data shows luxury consumers actively seek out brands that embrace circularity and prove their ethical credentials.

Sustainability, ethical expectations, and luxury go hand in hand

Transparency, diversity, and sustainability are critical; as a result, second-hand and circular models are also on the rise in the luxury retail sector, with interest rising in luxury resale, rental, and repair services. As an increasing number of buyers opt for second-hand luxury items, engagement with brands that disclose their sourcing, production, and labour practices, while actively promoting diversity and social responsibility, tends to be higher among young consumers: Between 50 and 60% of Gen Z and Millennials express concern about the ethics of luxury brands.

Key developments in sustainable luxury retail

- Resale and Rental Models: Clothing rental service Nuuly, launched by Urban Outfitters offers pieces by a selection of contemporary brands and is growing fast. The company utilises this service as part of its growth strategy.

- Link Sustainability to Quality: The majority of buyers purchase luxury items due to their link to premium quality. The association between sustainability and quality can be strengthened through durability, which will be appealing to luxury consumers seeking high quality while acting sustainably.

- Proof of Authenticity: To protect exclusivity and consumer trust, brands are investing in digital certificates of authenticity, blockchain tracking, and transparent supply chains.

How is Technology Changing Luxury Retail?

Digital progress permeates the entire luxury retail sector and is reshaping a multitude of touchpoints from Artifical Intelligence (AI) personalisation and augmented and virtual reality (AR/VR) shopping tools to the rise of social commerce.

Extending the Digital Experience

Some luxury brands are exploring metaverse technology, such as AR and VR to improve consumers’ online experiences and provide a smooth customer interaction. The Gucci App, for example, offers AR-based footwear and makeup trial features.

Proof of authenticity and transparency

As the luxury retail market evolves, proof of authenticity is emerging as a top priority for future shoppers. Concerns about counterfeits and dupes are rising, particularly with the growth of online and peer-to-peer marketplaces. In this economic climate, luxury consumers increasingly expect digital certificates, blockchain-enabled tracking through product passports, and transparent supply chain information. These measures are not only vital to protecting exclusivity but also align with new sustainability legislation, which is raising the bar for accountability. Mintel data shows that, particularly in the UK, affluent shoppers show strong interest in guarantees of authenticity and transparency about product origins.

Understand the Next Generation of Luxury Consumers with Mintel

Luxury retail is no longer as straight forward as it used to be — once defined by status and price — it is increasingly shaped by emotion, ethics, and experience. As luxury consumers look for purchases that reflect their identities, values, and aspirations, brands are being pushed to evolve faster than ever before. Personalisation, digital integration, and circular models will be key levers to building long-term trust and loyalty.

Looking ahead, the luxury retail market’s most successful players will be those who align with the new expectations of Gen Z and Millennial luxury consumers, delivering innovation and inclusivity without compromising on exclusivity. Is your brand ready to take on the challenge?

Visit Mintel Store for the full range of market research reports, or explore all our Retail Reports on Mintel Store.

Or sign up to our free newsletter Spotlight to have valuable market and consumer insights delivered directly to your inbox.