Let’s discuss how today’s economic landscape is impacting the consumer mindset by exploring the consumer trends that have shaped the last two recessions, as well as what brands need to prepare for in 2023.

Not every downturn is equal

The 2008 recession was an acute economic downturn triggered by the bursting of the housing bubble. From this period came the Mintel Trends:

- Let’s Make a Deal (2010): Consumers were seeking out engaging retail experiences as an antidote to impersonal online shopping. Then behaviors shifted as they began searching for a similar level of enjoyment in the purchasing—and in particular the saving—process. Scoring discounts has evolved from a chore into a form of entertainment, a source of pride, and even a full-fledged hobby.

- Prepare for the Worst (2011): Consumer caution can manifest as a reluctance to spend, but also as a desire for things that promise durability or protection, whether physical or emotional. Those who remember the upheavals of previous decades emerged with something of a bunker mentality and are looking to prevent, prepare, save, hedge, and otherwise get ahead of potential disaster wherever possible.

- Entrepreneurial Spirit (2012): The digital world brought people opportunities they were unlikely to have before. While the rise of the internet opened a new channel for communication, it also opened a new channel for commerce. The online environment has enabled people to bring their business ideas to life without much in the way of investment, resources, or support.

- Survival Skills (2011): Cost cutting developed into a desire for self-reliance and a need to learn lost skills and take pride in doing it ourselves. Resilience is defined as the ability to recover from, or adjust easily to, misfortune or change. The recession re-introduced this concept to millions of consumers. And it turned out that many of them found resilience rewarding.

The mid-pandemic recession of 2020 was brief (two months) and highly intertwined with public health policies. From this period came the Mintel Trends:

- Enjoyment Everywhere (2022): Having endured pandemic lockdowns, consumers are eager to break out of their confines and explore, play, and embrace novel experiences, both virtually and in the physical world. Brands are recognizing the importance of giving people a lift during times of uncertainty and distress.

- Flexible Spaces (2022): Public and private spaces are taking on new uses to adapt to how consumers work, learn, and socialize—all without diluting their core purpose. The pandemic forced consumers to creatively utilize outdoor spaces but has left consumers craving more regular interaction with the outdoors. Now, consumers are seeking infrastructure and products that work with nature rather than against it.

Consumers are facing economic uncertainty with a different mindset heading into 2023. They’ve already gone through a period of sacrifice. They can make do with less, but want to maintain their quality of life. Emerging from this period are the Mintel Trends:

- The Spiritual Self (2022): Spirituality is expanding to include personal growth and reflection as consumers desire a deeper understanding of their purpose. Traditional religious practices are still deeply connected to spirituality, but consumers are broadening their perspectives to incorporate a more personal mindset.

- Intentional Spending (2023): With reduced discretionary funds to spend, more consumers are forced to evaluate what’s most important to them—what they really need.

What to expect in 2023: Intentional Spending

Consumers have a new value equation. It isn’t just volume x quality = price. Shoppers are weighing price against convenience, sustainability, ethics, and other hard-to-measure or even intangible assets. Mintel has defined this Trend as ‘Intentional Spending.’

“Moving through uncertainty requires wise use of resources. Consumers are refocusing on what value means to them and spending more intentionally.”

– Joey Kong, Mintel Trends Analyst, APAC

With reduced discretionary funds to spend, more consumers are forced to evaluate what’s most important to them—what they really need. This spans their immediate needs, what brings them pleasure and escape, and their longer-term goals. For example, over the past two years, we’ve seen the rise of self-care and holistic wellness. These are now deeply ingrained ideas and habits for consumers, and those won’t all disappear as people reassess their budgets.

Consumers are looking for new solutions and brands that save them money while maintaining their standard of living. Instead of feeling bad about cutting back, brands can empower consumers to shift their mindset from ‘making do with less’ to ‘needing less’—it’s framed as a choice, not a sacrifice. Being thrifty and sensible with one’s resources is becoming trendy, smart, and admirable. Expect an empowering mindset shift from ‘making do with less’ to ‘needing less’.

The ‘Value’ Trend Driver

But ‘Intentional Spending’ isn’t the only trend we’re tracking right now that will help companies and brands understand this new value equation in 2023 and beyond. Because ‘Value’ is one of our Seven Trend Drivers—a framework that is used across all Mintel content—we’re tracking multiple facets of value.

The ‘Value’ Driver asks the question: How are budget, convenience, quality, and premiumization shifting over the next 12 months and beyond? The pillars under this trend driver are ‘Budget,’ ‘Convenience,’ ‘Quality,’ and ‘Premium’ and we can look at all of Mintel’research through those different lenses.

Two other consumer trends in particular provide contrasting points of inspiration for brands. ‘Let’s Make a Deal’ is a trend we’ve been tracking for several years (as mentioned above) and, while it’s a budget tactic, it’s also about empowerment and celebrating getting the best price. Brands are encouraging consumers to find joy in getting the best price and celebrating their financial savvy.

On the other hand, we have a new trend called ‘Trading Up’ that states the concept of premium is relative; some consumers are looking for added value—quality, functionality, and durability—while others are in search of emotional connection through indulgence and exclusivity. Delivering premium in ways that elevate a consumer’s quality of life can still be relevant even during a recession.

What we’re seeing in the market

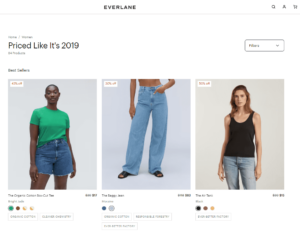

In August 2022, Everlane reduced prices on popular clothing items to reflect the prices the brand offered in 2019 to combat inflation for a limited time. In a promotional email, the brand stated, “We’re tired of unprecedented times (and prices). So we’re going back to our precedented prices in a few of our favorite styles.”

As retailers adapt to inflation, the way they market their products has to adjust as well. Everlane could have simply hosted a sale, but the specific messaging framework it used for the promotional sale is worth noting. As Mintel Trend ‘Never Say Die’ states, the cycle of nostalgia has shortened and most consumers reflect on 2019 as a simpler time in contrast to the uncertainty brought on by the COVID-19 pandemic in the following year. Everlane is leveraging the momentum of nostalgia to differentiate its sale from other retailers and encourages consumers to indulge in their memories of the past.

Fashion resale marketplace Depop and Kellogg’s partnered to release one-of-a-kind, thrifted looks inspired by Pop-Tart flavors. The Pop-Tarts x Depop Collection features five collections of hand-selected pieces curated by Depop creators. The items in the collections were inspired by different Pop-Tart flavors, are size- and gender-inclusive, and affordably priced at $3.59, the same price as a box of Pop-Tarts.

This collaboration targets Gen Z consumers, a young demographic that balance their limited budgets with a desire to be unique and celebrate their individuality. For these consumers, online resale marketplaces such as Depop give them the ability to browse through more affordable and curated clothing pieces that match their personalities. Instead of launching nostalgic, branded content, this collaboration leverages the power of the influencer, giving young designers creative control over their collections. With the rise of Y2K-inspired styles, nostalgic snacks such as Pop-Tarts fall into this genre, and as this collection shows, can prove to be a source of inspiration for young, aspiring stylists.

To learn more about the consumer trends Mintel predicts will shape industries, markets, and innovation in 2023, download the free ebook. To find out what the impact of inflation and recession on consumer behavior will mean for the future of your business, please get in touch.