Are Consumers Still Buying Cheese as a Staple Product?

Cheese remains a global staple, but how firmly it holds that position varies across markets. In the US, UK, and Germany, cheese is deeply woven into everyday eating habits, with some of the world’s highest per-capita consumption with strong per-capita spending. Even so, inflation has reshaped cheese consumption behaviour: Consumers are becoming more value-driven, with many trading down or adjusting purchase frequency. The question for brands in these mature markets is less about generating demand and more about influencing format, value perception, and usage occasions.

In contrast, Japan and Thailand illustrate very different stages of cheese consumption. Japan’s annual per-capita consumption of cheese remains low, but spending is high, driven by a preference for processed cheese and national brands, dominating the local market. Thailand, meanwhile, is a fast-developing market where cheese is gaining cultural familiarity.

Read on, to gain more insight into how economic pressures, shifting consumer priorities, and changing cultural contexts are redefining the cheese industry and cheese consumption habits across leading global markets.

How Cheese Consumption Is Shifting

Cheese consumption patterns vary significantly across markets, shaped by culture, economics, and shifting attitudes toward health and sustainability. In established cheese markets such as the UK, US, and Germany, frequency of consumption remains high, with a substantial proportion of consumers eating cheese daily. However, inflation has made price sensitivity more pronounced, particularly among lower-income households and younger consumers. This has accelerated a shift toward private label and value-tier options, especially in the UK and Germany where private label dominates the cheese industry. While cheese remains a habitual part of meals and snacking occasions, younger generations are increasingly attentive to environmental and health considerations, contributing to gradual reductions in consumption or interest in alternative cheese formats, such as powdered cheeses.

In Japan only around 4% of consumers eat cheese daily (Mintel Client Access Only), with most viewing it as an occasional addition rather than a staple. Women— particularly older women and mothers — are the most engaged consumer group, seeing cheese as a nutritious, calcium-rich food suitable for family meals. These consumers tend to be less price-sensitive and more consistent in their purchasing habits. In contrast, younger Japanese men, are more likely to treat cheese as optional and are quicker to cut back when prices rise. The opportunity for growth lies in encouraging higher consumption frequency among these younger groups by spotlighting the nutritional and functional benefits of cheese in everyday meals and snacks.

Thailand, by comparison, is a rapidly developing market where cheese is increasingly familiar but not yet integral to daily consumption. Over 80% of consumers report eating cheese, yet many fall into the “Cheese Casuals” segment whose consumption is stable but not increasing. Younger, urban consumers are driving experimentation, but the most promising segment is the “Cheese Champs.” These consumers are actively increasing their cheese intake and are receptive to premium products, new textures, bold flavours, and convenient snacking formats. Innovation, especially around portable, fun, and flavour-forward products, remains central to growing both consumption frequency and category value.

Emerging Cheese Eating Occasions

As consumption habits shift, new eating occasions are helping expand how and when consumers use cheese. Across markets, brands are encouraging experimentation by positioning cheese in meal moments where it previously played only a supporting role. These emerging occasions highlight cheese’s versatility, from protein-rich dinner options to portable lunch solutions and indulgent dessert innovations.

Cheese at the dinner table

- Cheese as a Meat Alternative: In France and Germany, cheese is increasingly positioned as a centre-of-plate protein. Products such as cheese mince, grillable cheese, and cheese patties offer a meat-free alternative for burgers, barbecues, and other main dishes.

- International and Fusion Dishes: In Germany and the UK, brands promote cheese as a flexible ingredient in global and fusion cuisines. Examples include Asian-, Middle Eastern-, or flavour-inspired formats such as Castello’s Taste Thailand Chilli & Ginger Cream Cheese Ring.

Opportunities in the cheese market: elevating lunch

- Portable Cheese Snacks: Snack packs, cheese sticks, and individually portioned cheese formats are positioned as convenient, nutritious lunchbox options for children and adults across the UK, US, Germany, and Japan.

- Cheese in Sandwiches and Salads: In the UK and Germany, brands highlight cheese as an easy way to elevate sandwiches, wraps, and salads, catering to busy consumers seeking quick, flavourful lunch solutions.

Indulgent cheese moments for dessert

- Dessert Cheeses and Cheese Sweets: The Japanese cheese market is leading innovation in cheese-based desserts, from cheesecakes and cheese jellies to cheese-flavoured ice creams. Many are positioned as indulgent yet “guilt-free” through low-calorie or low-carb claims.

- Sweet-Savoury Cheese Pairings: Globally, brands are blending cheese with sweet elements, such as fruit compotes, chocolate, honey, and baked goods, creating hybrid offerings that bridge savoury and sweet occasions.

- Cheese as a Meal-Ending Treat: In France and parts of Europe, individually portioned cheeses are marketed as a light, satisfying end-of-meal option, offering a savoury alternative to traditional desserts.

The Impact of Rising Food Prices on Cheese Consumption Habits

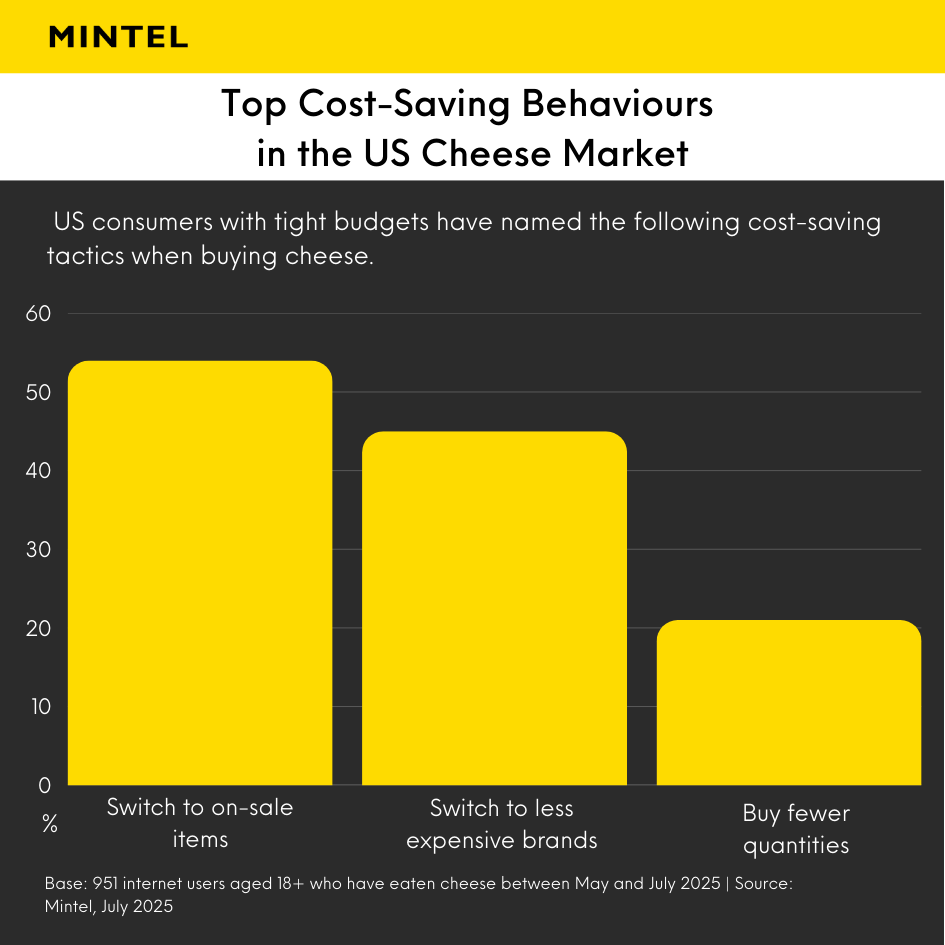

Across global markets, rising food prices have made cheese a focal point of cost-saving behaviour, but the degree of impact varies depending on how culturally embedded cheese is. In mature cheese markets such as the UK, US, and Germany, inflation has heightened price sensitivity, prompting shifts in purchasing behaviour rather than widespread rejection of the category. UK consumers, for instance, have responded with notable cutbacks: 42% say financial concerns would make them spend less on cheese, and nearly half are open to cheaper alternatives. Similar patterns emerge in the US, where budget-conscious shoppers switch up their buying behaviour if they’re trying to save money.

Markets where cheese is less established tell a different story. In Japan, where cheese does not hold staple status, price increases lead more directly to reduced consumption: Over 26% of consumers cut back when prices rise (Mintel Client Access Only).

Trends in Artisanal and Premium Cheese Consumption Trends

Even as inflation has driven some shoppers toward value options, discerning consumers continue to seek products that offer flavour, craftsmanship, and a connection to local or sustainable practices.

Premium and flavourful experiences

Consumers across the globe are increasingly seeking cheeses that offer richer flavours and indulgent experiences. Variety-rich selections, cheeseboards, and premium snack packs are gaining traction not only as special-occasion items but as everyday indulgences. Specialty formats, such as adult-oriented cheese sticks or portioned premium cheeses allow brands to differentiate themselves in competitive markets while appealing to consumers who prioritise taste, quality, and convenience.

Artisanal claims, including traditional processing methods, hand-crafted production, and regional origin, continue to enhance the perceived value of cheese and justify higher price points: Almost 40% of Gen X in the US are willing to pay more for artisanal cheeses.

Consumer Attitudes Towards Vegan Cheese Products

Interest in plant-based and vegan cheese is growing globally, driven by health, sustainability, and ethical considerations. While dairy cheese remains dominant in most markets, plant-based alternatives are carving out a niche. Across regions, several patterns are emerging, highlighting both opportunities and challenges for the segment.

Health, sustainability, and local sourcing

Healthy eating trends often intersect with broader sustainability demands as consumers look to blend dairy with plant-based options. For example, in the UK, Kerry has launched a range of oat and dairy blend products — SMUG Dairy — including cheddar cheese, milk, and butter. The brand claims the products give you the dairy taste, but with lower saturated fats and lower carbon emissions than standard dairy, making this product range both healthier and more eco-friendly.

Younger consumers are consistently the most receptive to plant-based cheese. In the US, 37% of all cheese consumers express interest in a plant-based option from a trusted brand, rising to over 50% among 25 to 44-year-olds. Similarly, in Germany, younger generations are increasingly motivated by health and environmental considerations, contributing to a rise in plant-based cheese consumption to 15% in 2024.

Key barriers to vegan cheeses: Taste, texture, and processing concerns

Despite growing interest, plant-based cheeses face significant hurdles. Poor taste, off-putting texture, and perceptions of over-processing remain the main concerns. In the UK, 36% of consumers cite poor taste; similarly, in Germany, 65% of consumers find long ingredient lists on dairy alternatives off-putting. Addressing these sensory and perception challenges is critical for broader adoption of vegan cheese trends in the future.

Flavoured and value-added products drive trial

Flavoured plant-based cheeses are particularly important in encouraging trial and repeat consumption, as they help mask undesirable taste and texture. In Thailand, where 39% of consumers express interest in plant-based cheese (Mintel Client Access Only), flavoured options are helping consumers transition from dairy products. Across markets, products that incorporate familiar flavours or added functional benefits, such as high protein or low fat, are proving more appealing than claims solely focused on environmental sustainability. Education and recipe inspiration also play a role: In Germany, almost half of home cooks want guidance on using plant-based cheese in cooking or baking, highlighting the novelty of the category and the importance of supporting adoption.

What Are New Cheese Formats and Products Driving Market Growth in 2026 and Beyond?

As global cheese consumption continues to evolve, innovation is shifting toward formats and experiences that better align with changing lifestyles, health expectations, and cooking habits. Growth in the coming years will be shaped not just by what consumers eat, but how and when they incorporate cheese into their daily routines. Across regions, this is opening opportunities for brands to reimagine convenience, flavour, function, and usage occasions.

Snackable and Convenient Formats are Taking Over Cheese Industry Trends

Snacking has become one of the strongest engines of growth across global cheese markets, with consumers increasingly seeking formats that offer both convenience and a premium feel. Easy-to-eat cheese sticks, individually portioned snack packs, and single-serve cheeses are gaining traction among adults, older consumers, and busy households alike. In Europe and the US, block cheese packaged in snackable portions is seeing strong uptake, while similar portion-focused formats are becoming popular in Japan.

New Textures and Flavours

Innovation in textures and flavours is reshaping cheese industry trends, particularly in markets where versatility and novelty are strong purchase drivers. Spreadable and melty cheeses are surging in popularity.

At the same time, demand for bold and adventurous flavours is accelerating. Across North America and Europe, consumers are seeking cheeses with richer aromas, spicy or sweet flavour notes, and globally inspired combinations. This appetite for bolder profiles is mirrored in the plant-based cheese segment, where flavour innovation is essential to overcoming taste and texture barriers. Together, these trends signal an openness to experimentation and provide opportunities to engage flavour-driven consumers through limited editions, seasonal offerings, and cross-cultural inspirations.

Functional and Health-Focused Cheeses

Health-forward cheeses are emerging as a distinct growth vector, driven by families, wellness-oriented shoppers, and ageing consumers looking for more from everyday products. High-protein and probiotic cheeses are attracting strong interest, positioning cheese as a nutritious snack or meal component rather than an indulgence alone.

Newer innovations, such as A2-milk-based cheeses and fibre-enriched varieties, are tapping into digestive wellness, longevity positioning, and “tummy-friendly” claims. These products resonate with those who experience sensitivities to conventional dairy or who seek functional foods that support broader wellbeing goals. As health considerations increasingly shape food choices, functional cheeses offer brands a credible way to differentiate and expand consumption moments.

New Usage Occasions

Cheese consumption trends and usage occasions are expanding rapidly, reflecting shifts in consumer lifestyles, meal patterns, and cross-cultural culinary exploration. One of the strongest macro-trends is the rise of cheese as a versatile ingredient. Across Asia, cheese is being incorporated into rice dishes, instant noodles, baked goods, and snacks, bridging global and local eating habits. Shredded, sliced, and powdered cheeses are especially well-suited to these formats, allowing seamless integration into everyday cooking.

In Western markets, efforts to diversify usage beyond traditional bread pairings are gaining importance. While cheese-on-bread remains a staple, brands are encouraging consumers to use cheese more dynamically in main dishes, sides, salads, and meal enhancements. Social media is playing a notable role here: In Germany, more than a third of consumers have experimented with new cheese applications after seeing recipes online.

As cheese becomes a fixture in both traditional and new eating moments, brands have increasing room to innovate—whether through formats designed for specific dishes, hybrid snack products, or inspiration-led communications that expand the role of cheese in modern diets.

Looking Ahead with Mintel

Cheese consumption is changing, but demand isn’t disappearing — it’s transforming. With consumers redefining value, seeking new formats, and embracing global flavours, the cheese industry’s next phase will reward brands that innovate with purpose and respond authentically to emerging needs.

Explore more market research on the dairy industry and dairy alternatives by browsing Mintel Store.

Or sign up to our free newsletter Spotlight to have valuable market and consumer insights delivered directly to your inbox.